Four weeks ago, I shared with you a high level preview of the Innotribe Sibos 2016 programme.

As promised, I have revealed more details for each day in some subsequent blog posts leading up to Sibos week 26-29 Sep 2016 . Today – 15 days before D-day – this post is the last in that series, and I will be looking into day-4.

We are now in the phase where all the artwork, design, session facilitation props, staging, lightning and special effects are coming together. We are now in nonstop back-to-back joint speaker calls to make sure our session cast, our speakers, our instigators, our producers, designers, and facilitators are full aligned. Some of the material we are producing for the big LED screen is of a beauty we have rarely seen in other event environments.

Yes, we try very hard to beat last year’s edition 😉

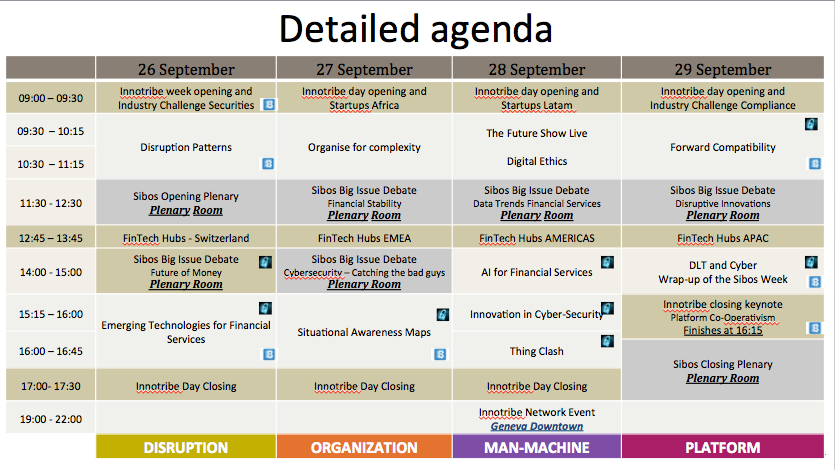

The structure of the week program is fairly straightforward:

- We start every day with an opening of the day

- We close every day with a closing of the day

- Over lunch time, we have spotlight sessions by several FinTech hubs: one day for Switzerland, one for EMEA, one for the AMERICA, one of APAC.

For the opening session of day-4, the Innotribe team will welcome you, and will zoom in into our Innotribe Industry Challenge on Compliance/KYC.

Our day anchor will then walk you through the plan of the day. Given that our day-4 is about the platform cooperation, our day anchor is Leda Glyptis, Director, Sapient Global Markets. She will stir the pot where needed during the day and she will come back at the end to wrap up the learnings of the day.

In between opening and closing, we have several Innotribe sessions. We don’t do anything during the plenary big issue debate so you have the time to enjoy that session as well.

The main theme of Innotribe day-4 is “Platform Cooperation”. In addition of the Opening and Closing sessions, we have four sessions:

- Forward compatibility

- FinTech Hubs session – APAC

- DLT and cybersecurity: Sibos week wrap-up

- Innotribe closing keynote: Platform Cooperation

This is a consolidation day – where it all comes together – and we will use a lot of metaphors and medieval painting examples to contextualise these rich topics, and to guide you through the disruptive complexity of our times

Pieter Breughel the Elder - The Blind Lead The Blind

Forward compatibility

I wrote a blog post about “forward compatibility” in March 2016, about how to avoid simplistic conversations on disruption.

That post was inspired by two conversations.

- One conversation was in January 2016, with Angus Scott from Euroclear, and his key insight was that no disruption will happen without fundamental re-invention of the end-to-end business processes, and that requires what I now call “forward compatibility”, looking into big large scale experiments with real customers, real regulators, and real ecosystem stakeholders, aka not just in a Lab. Angus also injected the concept of broad macro-forces that drive change.

- The other conversation was in March 2016 with Valerio Roncone and Tomas Kindler from SIX. They explained me how they were looking far ahead. Asking questions such a “what happens after T2S?”, or “what happens if DLT would fulfil its promise, and disinter-mediate existing players in the industry?”. How does the new landscape look like? Can we create “situational awareness” that can inform our strategy? They called this “impact oriented thinking” and “innovation through evolution”

The seeds were planted, and that was the embryo for this session.

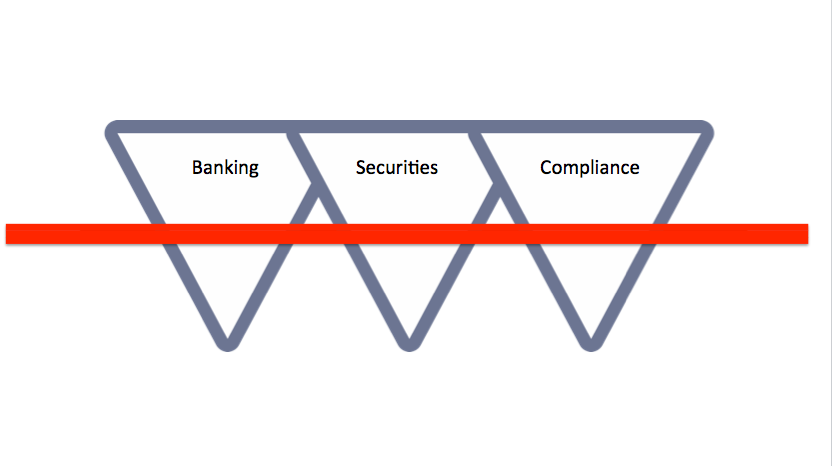

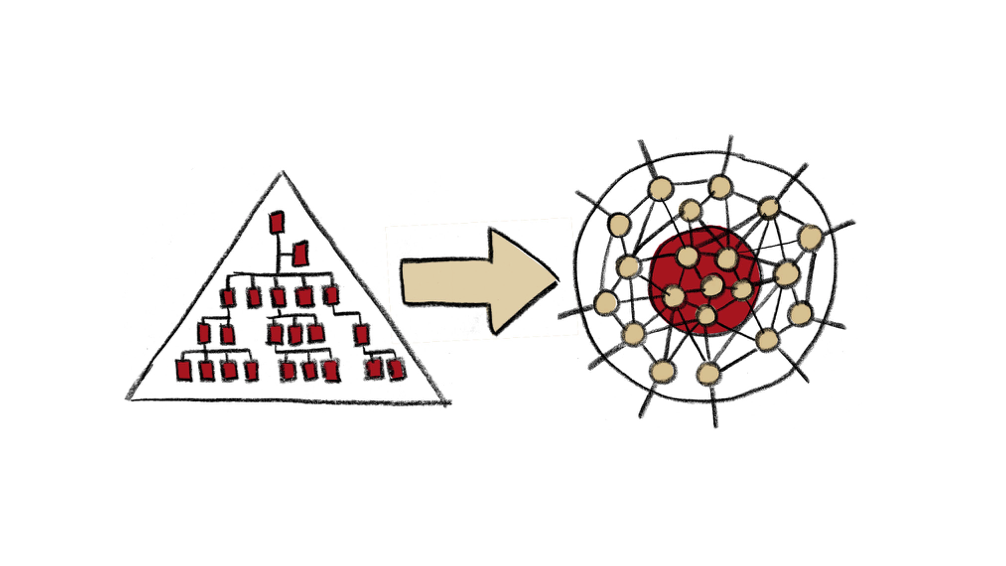

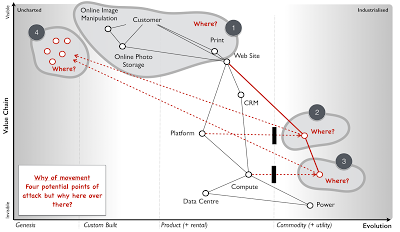

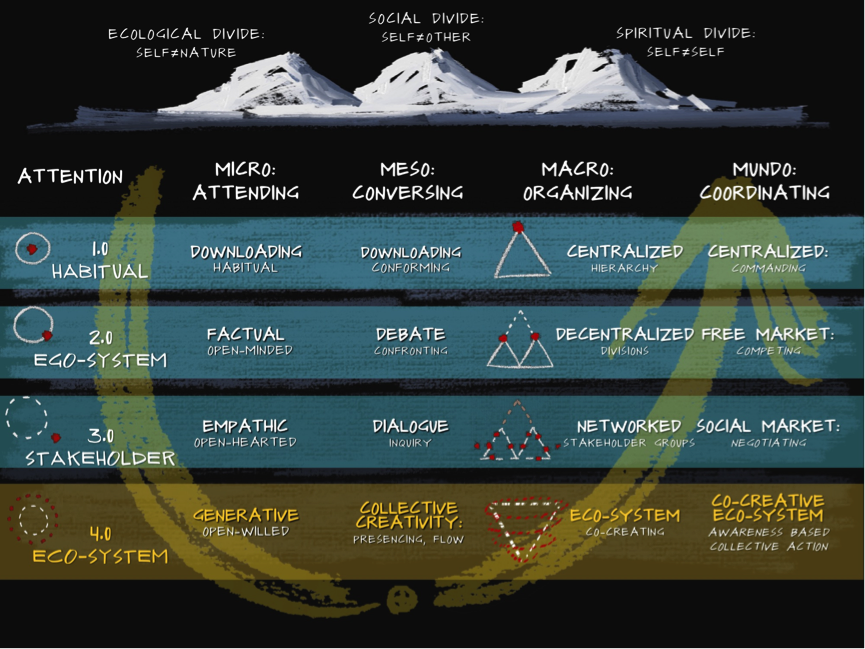

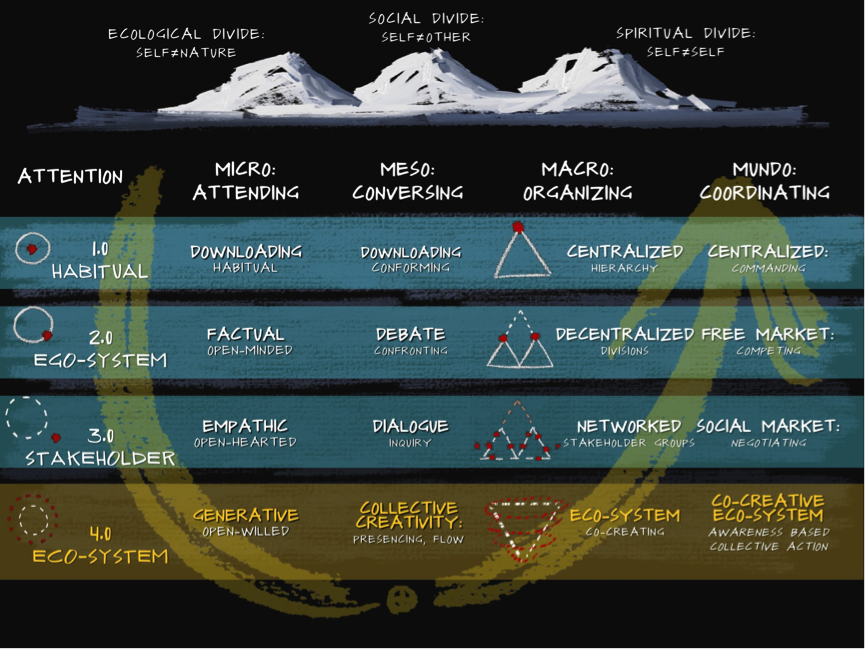

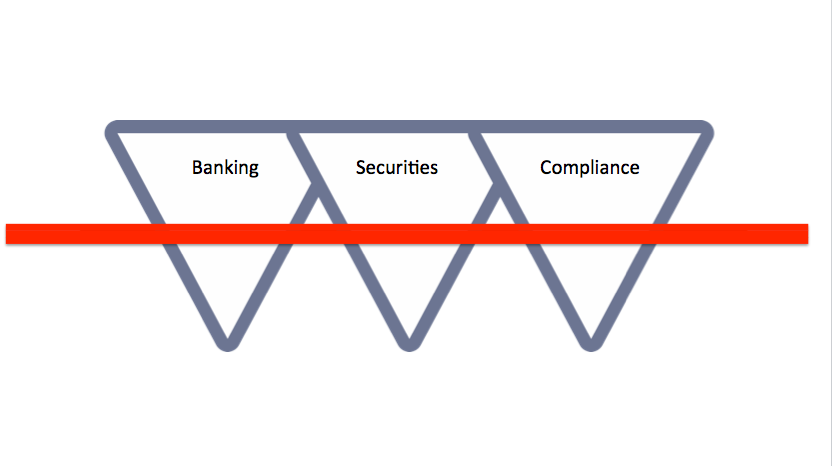

I started playing around with this, and came up with the concept of “above and below the red-line”:

- Below the red-line is what needs be be solved as a collective, as a community, as a platform. It’s stuff that no single company can really solve on it’s own. It’s things like DLT, Cybersecurity, Digital identity, etc

- Above the red-line is where you partner with others, FinTech startups, established vendors, etc through JV’s, Partnerships, API’s, etc. It’s where you “complement” the platform under the red line

Throughout the week, we will have done some exercises, where we internalise the content from the speakers by mapping them above and below the red line, and see how they are relevant for banking, securities, and compliance.

This session is NOT a technical session for geeks. This session is a session for business strategists that are interested having a conversation on how we can move the collective forward from here to “there”, wherever and however the “there”emerges.

We have a BIG cast for this session, complemented by instigators, DLT/Cyber anchors and rapporteurs. This is the only session where I will be on stage as your moderator. The speakers and instigators for this session:

- Angus Scott, Euroclear

- Valerio Roncone, SIX

- Tomas Kindler, SIX

- Patrick Havander, Nordea

- Paul McKeown, Nasdaq Financial Framework

- Saket Sharma, BNY Mellon

- Brian Behlendorf, Hyperledger Linux Foundation

FinTech Hubs session – APAC – over lunch time

Building upon the success of last year’s session “Why banks need FinTech hubs?”, we wanted to go create more air-time for FinTech Hubs from different regions of the world.

We’ll have 6 speakers in one hour. That’s 10 minutes each to share their ambitions and plans. With our designers we are looking how we can make this an engaging experience and avoid having a series of 6 commercials. Like for all FinTech Hub sessions this session is full house.

The “6 from APAC” are (in order of appearance):

- James Lloyd, Asia-Pacific FinTech Leader, E&Y

- Markus Gnirck, Tryb

- Sopnendu Mohanty, MAS

- Zennon Kapron, FinTech China

- Janos Barberis, FinTech HK

- Asad Naqvi, Apis Partners

Almost all of the hubs presenting at Innotribe Sibos during these hub sessions are now part of the Global FinTech Hub Federation (GFHF) announced three weeks ago. See press-release here.

The GFHF will premier their latest FinTech Hub Index (A benchmark of 20+ FinTech Hubs) at Innotribe Sibos 2016. I have seen the design and infographics for this Index, and they just look awesome. We will use some of them as backdrop for this session.

Sandwiches and soft drinks will be served in the Innotribe space.

DLT and cybersecurity: Sibos week wrap-up

The Tribuna of the Uffizi, by Johan Zoffany, 1772-8

A collection of paintings

Royal Collection, Windsor

As you for sure have noticed, we don’t have any DLT/Blockchain sessions in this year’s Innotribe Sibos programme. We did this on purpose for two reasons:

- There are already a lot of DLT/Blockchain sessions in the main conference sessions of Sibos

- We sense a certain fatigue on the topic

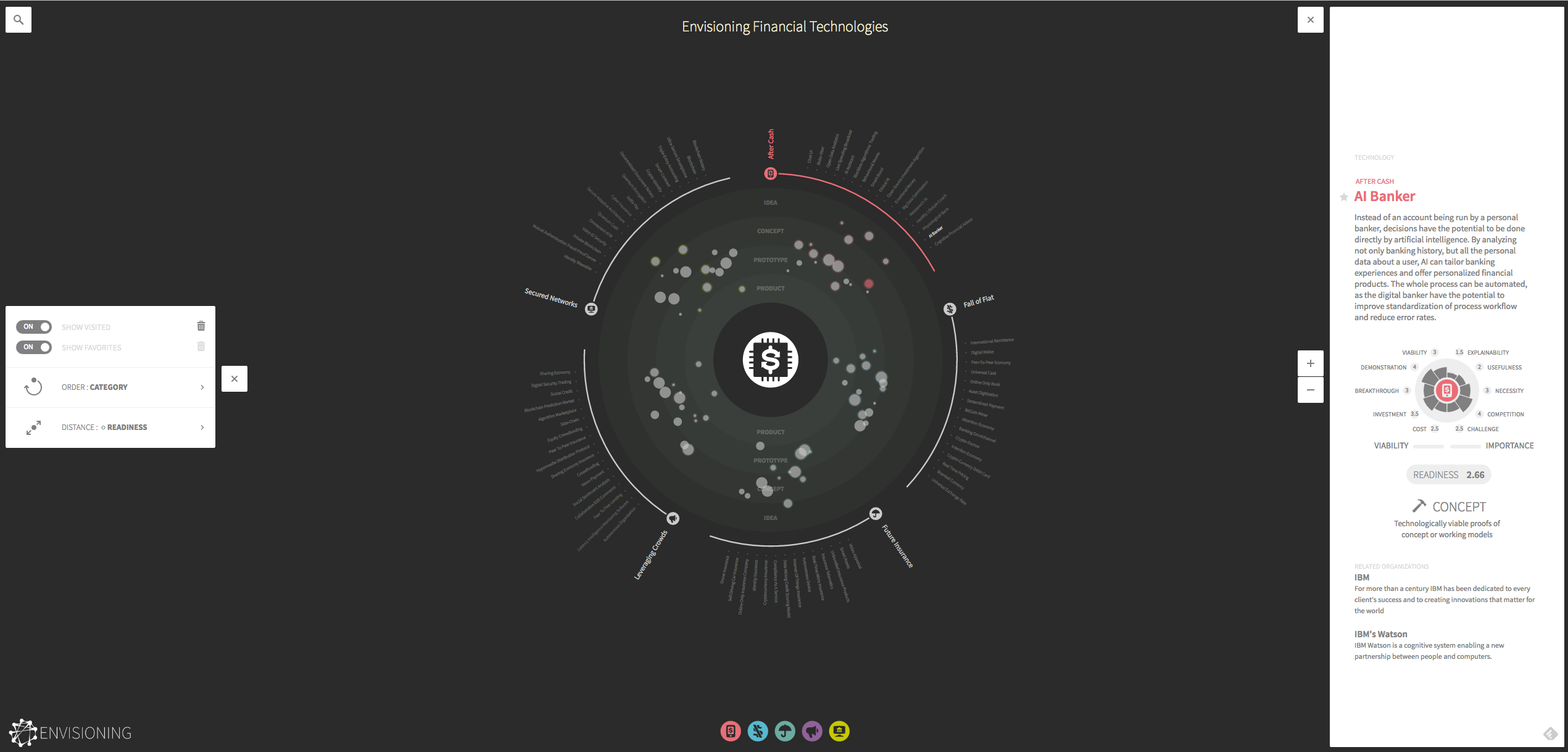

We set ourselves the challenge to create ONE session where you get an overview, a collection of insights from ALL the sessions related to DLT during the whole of Sibos.

So if you don’t have time to go to all of them, or you prefer to stay in the Innotribe space for the week, we’ll make sure you get the key learnings in this single wrap-up session.

And as we were at it, why not do the same with Cybersecurity? OK, let’s do that too.

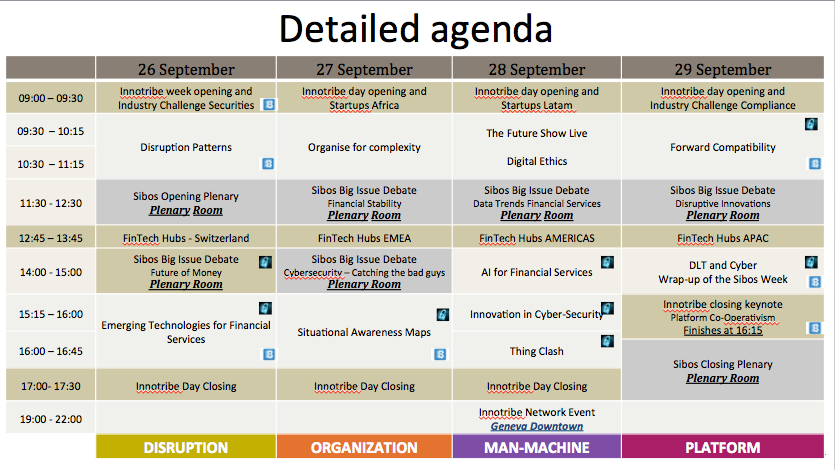

General overview of the Innotribe Sibos 2016 programme

In the general overview of Innotribe sessions above, you will see some sessions marked with the “B” sign (Blockchain) and some others marked with the “lock” sign (Cybersecurity). It means these sessions have some DLT/Cyber flavour to them.

To create a coherent summary during this Thursday wrap-up, we have appointed “Transversal DLT/Cyber anchors”. They stay in the Innotribe space for the whole week, and will report back their findings:

- Our DLT transversal anchor is Andrew Davis, advisor from Sydney

- Our Cyber transversal anchor is Bart Preneel, University of Leuven

To cover DLT and Cyber from the other non-Innotribe sessions (aka the main Sibos sessions, Swift Lab, workshops etc, we are sending out our “rapporteurs”. Our Rapporteurs are:

- Our DLT rapporteur is Oliver Bussmann, ex-CIO UBS

- Our Cyber rapporteur is Assaf Egozi, CEO Kidronim, Israel

Our DLT/Cyber anchors and rapporteurs will have a special lanyards so you can recognise them easily.

Innotribe closing keynote: Platform Cooperation

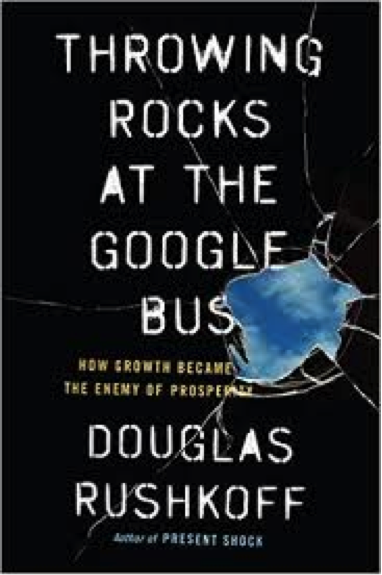

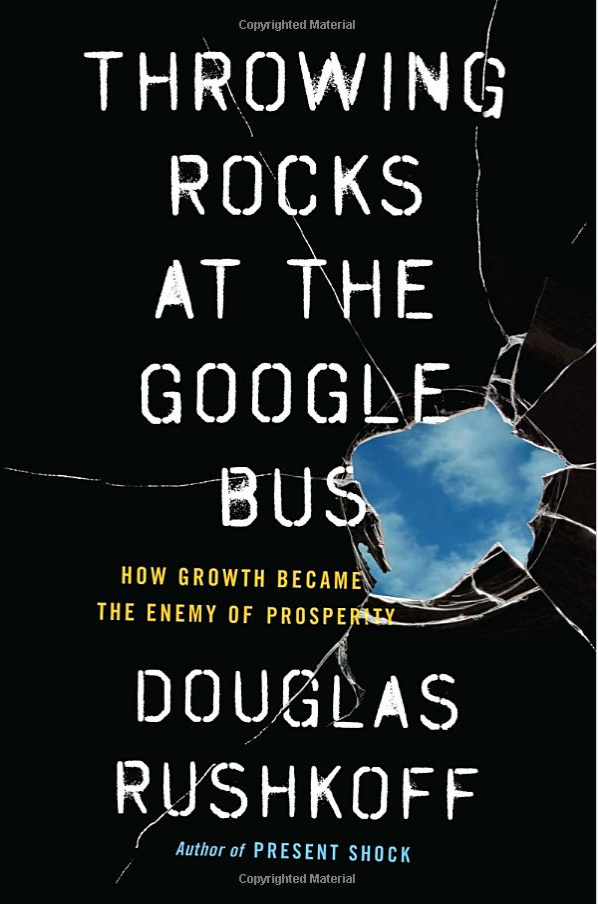

After a short wrap up of the Innotribe week presenting the key findings of our programme, our closing keynote speaker Dr. Douglas Rushkoff will provoke and challenge all your assumptions.

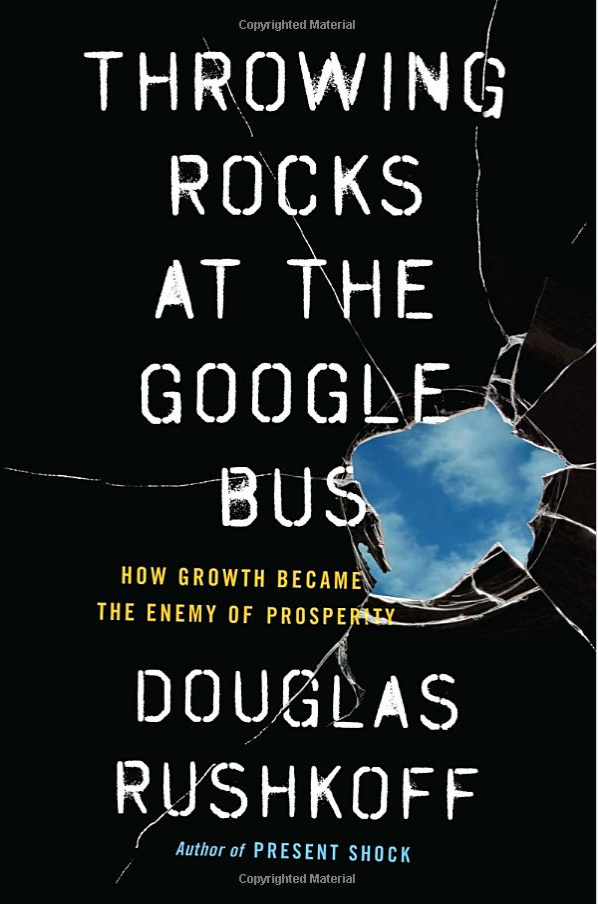

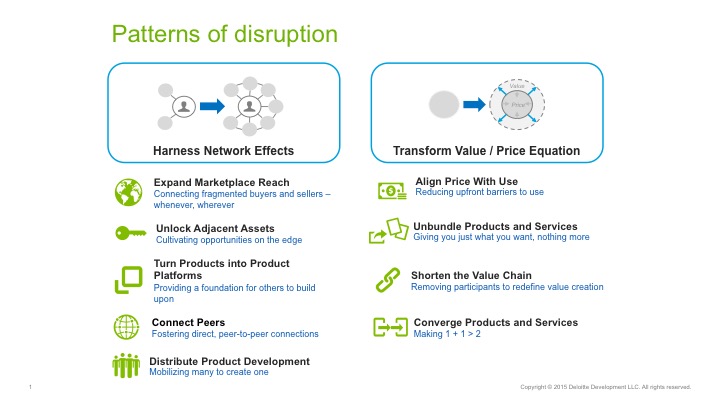

Rushkoff is a renown lecturer on media, technology, culture and economics around the world. His new book “Throwing Rocks at the Google Bus: How Growth Became the Enemy of Prosperity” (Amazon Affiliates link) argues that we have failed to build the distributed economy that digital networks are capable of fostering, and instead doubled down on the industrial age mandate of growth above all.

“Every great advance begins when someone sees that what everyone else takes for granted may not actually be true. Douglas Rushkoff questions the deepest assumptions of the modern economy, and blazes a path towards a more human centred world.”–Tim O’Reilly, founder of O’Reilly Media about Rushkoff’s latest book.

Marketplaces in medieval times were far more human centred, fairer environments that the so called P2P sharing economy of Uber and AirBnB, which all have little to with sharing but much more with an extraction value economy where only a few (monopolies) take it all.

A Medieval marketplace scene from Pieter Breughel the Elder.

After his talk, Doug will stay on our stand and take some time to do some book signings. He’ll have a couple of free books with him.

Rushkoff is one of those rare thinkers and speakers that challenge all your assumptions. We did something similar last year with Andrew Keen with his talk “The Internet is NOT the answer”. Many of you loved his energy as the Anti-Christ of Silicon Valley.

Think of Rushkoff as Andrew Keen on steroids. Not to be missed if you like to be inspired, if you like to be provoked.

Since publishing Throwing Rocks at the Google Bus, Rushkoff has answered more than 20,000 emails from his readers, one by one, individually. People, companies, mayors, cooperatives, towns and big corporations, all looking for ways to distribute prosperity more widely, start local currencies, build platform cooperatives, convert to employee ownership, offer dividends instead of capital gains, or crowdfund a bookstore.

Rushkoff realised it was not about him but about you and last week he launched Team Human, a weekly postcast on radio. “An intervention by people, on behalf of people”. All in delightful audio – perhaps the most intimate, enveloping medium yet developed.

Douglas Rushkoff looks deep into the question of reprogramming society to better serve humans. Rushkoff grapples with complex issues of agency, social justice, and all those quirky non-binary corners of life.

We are also bit quirky, non-binary. That’s why we designed the Innotribe stand with a very industrial look on the outside but as a very human and welcoming space on the inside. We believe on the synergising effect of emotional and physical space.

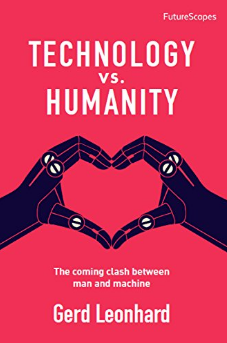

- That’s why the overarching theme of this year’s Innotribe Sibos is about the tension between technology and humanism in this fast changing and disruptive environment.

- That’s why we use a lot of art, as art can help making sense beyond the tactics and the cognitive.

- That’s why we have throughout our four days the concept of “above and below the red line”, as below the red line is what we need to solve as a collective, as a community, as an ecosystem.

It’s going back to the original intention of the not-for-profit cooperative structure, but mixed with some healthy activism. Ruskhoff calls this “Platform Cooperativism”

Hope the architecture of our Innotribe Sibos 2016 programme all starts making sense now?

I will leave you with this painting/collage by Yasumasa Morimura “Blinded by the Light” from 1991. It’s a picture from a reproduction, discovered in the lobby of Le Meridien Hotel in Minneapolis, Minnesota, US, during my presence at the SparkCamp conference in 2015.

It is a modern interpretation of Breughel’s “The Blind lead the Blind” from 1568. See start of this post.

The landscape of both paintings is from a really nice area west of Brussels – an area named “Pajottenland” – and the chapel in the back of the paintings exists in a little village called “Sint-Anna-Pede“.

It happens to be the place where I grew up the first 20 years of my life. I was living literately 200 metres from this chapel. So the Innotribe journey sort of brought be back to my roots. More about that after Sibos.

General

All sessions are designed to maximise the immersive learning experiences of our guests. We use professional facilitators and designers to enable great group interactions. And we have an amazing audio/visual kit and production team to make the content come alive.

The pepper and salt comes from our “instigators” who have a designed role to provoke the critical discussion.

Resources:

Follow us on Twitter: for the latest announcements: @Innotribe, #Innotribe,@Sibos, #Sibos

We are looking forward to meeting you all again at this year’s Innotribe Sibos 2016 from 26-29 Sep 2016 in PalExpo, Geneva.

Deeply grateful,

Your architect and content curator for Innotribe@Sibos, @petervan