Two weeks ago, I shared with you a high level preview of the Innotribe Sibos 2016 programme.

As promised, I will reveal more details for each day in some subsequent blog posts leading up to Sibos week 26-29 Sep 2016 (37 days left at the time of this writing).

Our preparations are in full swing. We are in the midst of a series of intense prep calls with all speakers, together with our production teams and our facilitators and designers. All engines are on!

It has always been our intention to build a program with architectural integrity and a week of intense learning experiences. This year is no different.

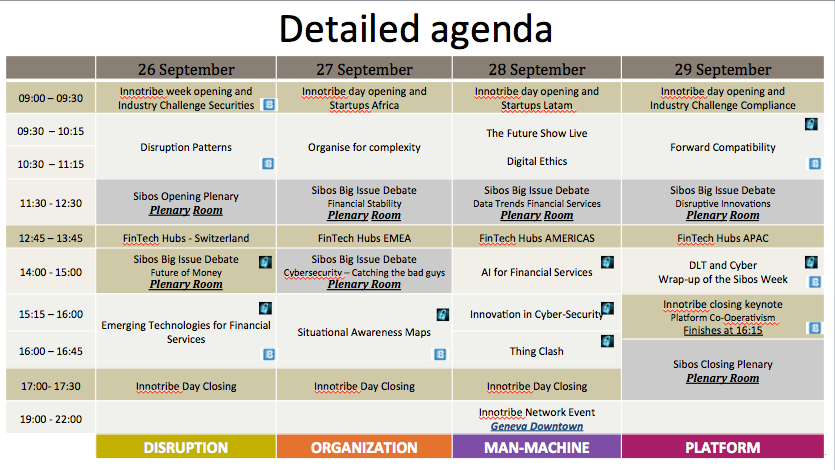

General structure:

General overview of the Innotribe Sibos 2016 programme

The structure of the week program is fairly straightforward:

- We start every day with an opening of the day

- We close every day with a closing of the day

- Over lunch time, we have spotlight sessions by several FinTech hubs: one day for Switzerland, one for EMEA, one for the AMERICA, one of APAC

For the opening session, the Innotribe team will welcome you, and for the Monday opening, we will zoom in into some highlights of our Innotribe Industry Challenge on Securities (about issuing a bond on the blockchain).

Our day anchor will then walk you through the plan of the day. Our day-1 anchor is Michell Zappa from Envisioning Tech, Brazil. He will come back in the day closing to wrap up the learning of the day.

In between we have several Innotribe sessions. We don’t do anything during the plenary big issue debates so you have the time to enjoy those as well.

The main theme of Innotribe day-1 is “disruption re-defined”. We have three sessions:

- Patterns of disruption in wholesale banking

- The Future of Money

- Emerging technologies for financial services

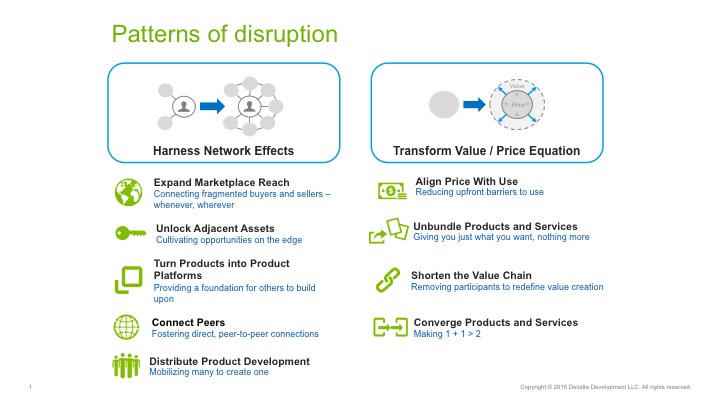

Patterns of disruption in wholesale banking

Learn to anticipate and react to disruptions in Securities, Trade Finance and FX.

Begin 2016, the Deloitte Center for the Edge published a deep research on nine patterns of disruption cross-industry. Upon our request, Deloitte created a special version for Innotribe Sibos on the relevance of these disruption patterns for financial services, and how incumbents can/should react to them.

Key take-aways of this session will be:

- Reframe the notion of disruption

- Understand there are patterns of disruption

- There is a way to be more rigorous in understanding and anticipating disruption

- There are some effective ways to respond to disruption in a purposeful way

- Apply these insights to our world of wholesale banking and think of specific action steps that can be taken by our organisations

The rock-star line-up for this session:

- John Hagel, Co-Chair, Deloitte Center for the Edge

- Val Srinivas, Research Leader, Banking & Capital Markets, Center for Financial Services, Deloitte

This is a highly interactive session, with assignments for the audience, to help you internalise the knowledge you picked up from our speakers. At the end of the session, there will be a “gift” to take with you.

The Future of Money

For the first time, this ever-popular Innotribe session has been promoted as a full-blown “Big Issue Debate” in the main plenary room of Sibos.

The idea behind Future of Money is to essentially act as a crystal ball, examining the large shaping trends that are going to affect financial services in typically two to three year’s time.

Moderated by Udayan Goyal, Co-Founder and Managing Partner of Apis Partners and Co-Founder and non-executive director of Anthemis Group, this year’s Future of Money is set to discuss the Internet of Things (IoT) and how the collection of data in our highly networked world through sensor-based technology is set to change how we think of financial services.

Other topics include the rise of artificial intelligence (AI), with decisions regarding investments and creditworthiness becoming the purview of automated systems based entirely on inputs of personalised data.

The line-up:

- Jon Stein, CEO Betterment

- Carlos Menendez, President, Enterprise Partnerships, International Markets, Mastercard

- Amber Case, Cyborg Anthropologist and Fellow at Harvard Berkman Klein Center

We also tried to re-invent a bit the flow of a big issue debate and “sweat the technical asset” we have at our disposal. Expect more from Innotribe 😉

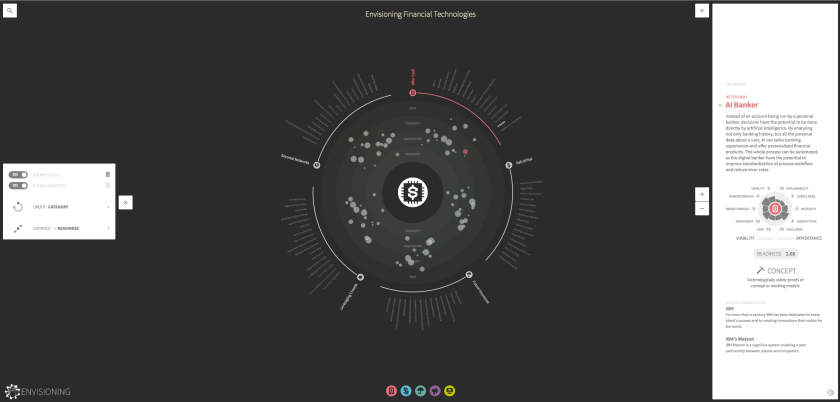

Emerging technologies for financial services

In this session, we will share the results of a research commissioned by Innotribe to Envisioning Tech from Brazil. Again, original research and a word premiere of a fantastic visualisation tool.

The different technologies will be mapped on different time horizons, and we will highlight the inter-connections between them.

Every technology will come with a navigation card detailing its relevance to the financial services industry around 10 different impact vectors – with a focus on cyber-security and distributed ledger technologies.

Screenshot of beta-version of visualisation tool

The session is animated with a spectacular screen-wide interactive visualisation.

The session is an interactive workshop with a card-game interaction with the participants. Seats will be limited.

General

All sessions are designed to maximise the immersive learning experiences of our guests. We use professional facilitators and designers to enable great group interactions. And we have an amazing audio/visual kit and production team to make the content come alive.

The pepper and salt comes from our “instigators” who have a designed role to provoke the critical discussion. The “instigators” of day-1 are:

- Patrik Havander, Nordea

- Anthony Brady, BNYM

- Matthew Grabois, BNP Paribas Securities Services

For the sessions where it makes sense, we also have a transversal anchor for Cyber-security and one for DLT. They stay in the Innotribe space for the week, and will report back at the end of the week:

- Our Cyber transversal anchor is Bart Preneel, University of Leuven

- Our DLT transversal anchor is Andrew Davis, advisor from Sydney

Next week, we will cover the themes and sessions of day-2 of Innotribe Sibos 2016.

Resources:

- All session timings and speaker bios can be found in the searchable Innotribe Sibos programme and on the Sibos App. Filter on track Innotribe.

- High Level PDF Flyer

- An upcoming Innotribe branded Magazine with interviews with some of our keynote speakers

Follow us on Twitter: for the latest announcements: @Innotribe, #Innotribe, @Sibos, #Sibos

We are looking forward to meeting you all again at this year’s Innotribe Sibos 2016 from 26-29 Sep 2016 in PalExpo, Geneva.

Deeply grateful,

Your architect and content curator for Innotribe@Sibos, @petervan

One thought on “Innotribe Sibos 2016 – Day1 – Disruption Redefined”