Headshot - Douglas Rushkoff

The first time I heard the term “Platform Cooperativism” was when listening to a talk by Douglas Rushkoff (www.rushkoff.com) on 15 Nov 2015 at the Internet Society.

Just a couple of weeks before, Doug had sent me a manuscript version of his new upcoming book “Throwing Rocks at the Google Bus: How Growth became the enemy of prosperity” (Amazon Associates link), planned for release in two weeks or so. I recall the working title of the book was “The end of growth”.

As usual – when listening to an interesting talk – I scribble notes on my notepad, pausing the video after every interesting sentence, and end up with some sort of transcript, somewhat personalized because using my own sense-making lens and bias.

Some snapshots:

- Before the law enforced monopoly, now technology enforces monopoly

- From creative destruction to destructive destruction

- A software company is a company extracting value from the working economy (transactions between people) and converts it into capital (static bags of shares and stock prices), converting land and labor into capital.

- Creating real value, that’s the suckers’ place (of being gamed). Playing the game is the place where you want to be

- Central currency is the embedded operating system

- Should we optimize for growth or optimize for humans?

- Jobs!, Jobs!, Jobs! Let’s pretend we are on acid for a minute ;-). Who really wants a “job”?

- Most companies, after reaching max growth, go for steady state, the flow of money

- Uber drivers are doing R&D for automatic cars. They don’t have a platform cooperative

- Family businesses are focused on the long term, are generational, are even willing to help other create value.

- From a growth model of business to a flow model of business

- Optimize for the velocity of money (not for being static, stocked in troves)

- We don’t need banks to authenticate

- The bank was made to extract value out of our transactions

- About Bitcoin/Blockchain (at minute 37): “what are they programming for?” Bitcoin creates trust? No, Bitcoin SUBSTITUTES trust

- In the end, we have to re-program the social expectations of each other

- There is some chance that the P2P economy may happen, that the extraction economy comes to its end, with interesting experiments

- We see hybrid models to fund pizzeria, 50% Crowd, 50% bank

- The bank as facilitator of local community development

- From platform monopolies to platform cooperatives

- Facilitating exchange of value between people instead of extracting value from people’s labor.

- We need a full-blown renaissance, and we are in it…

- From Perspective painting to the hologram and the fractal

- From the individual hero to collectivism

- From the printing press to the computer

- From enclosing the commons to retrieving the commons

- From divisional science to the science of whole-ism

- Land, Labor, and Capital as PARTNERS in an economy

- Today, capital is extracting from Land and Labor

The comments right after Douglas’ talk by Astra Taylor, author of the book: “The Peoples’ Platform: And Other Digital Dilusions” are interesting:

- I want (platform) cooperatism to be confrontational, it has to make a difference in the world

- How different is the current moment? If different at all….

- The key for cooperatives success is access to capital

Platform Cooperativism is possibly an answer to Platform Capitalism. Harold Jarche recently articulated very well what platform capitalism is really about: the extraction of value from many for the benefit of a few.

“The emerging economy of platform capitalism includes companies like Amazon, Facebook, Google, and Apple. These giants combined do not employ as many people as General Motors did. But the money accrued by them is enormous and remains in a few hands.”

And just a couple of days ago, David Bollier had a great post pointing to a new report on Platform Cooperativism by Trebor Scholz, one of the organizers of the Nov 2015 conference where Rushkoff spoke. Full report (PDF) report here.

“In the report, Scholz notes that the gig economy financializes resources that were previously outside of the market. Our cars, our apartments, our private time – all can now be monetized through corporate platforms and made subordinate to market forces. In effect, this new system is “embedding extractive processes into social interactions” and “extending the deregulated free market into previously private areas of our lives,” writes Scholz.”

Platform Cooperativism is a choice we have in the Industrial-Human Paradox. The WEF makes a lot of noise about “The 4th Industrial Revolution”, semi celebrating forms platform capitalism like the Uberization of everything, and robots eating our jobs.

It feels to me that sort of thinking starts feeling more as entertainment rather than independent thinking and provocation.

As Douglas Rushkoff said and provoked elsewhere: we don’t need to fix the system. The system just works fine for what it was designed for: extracting value.

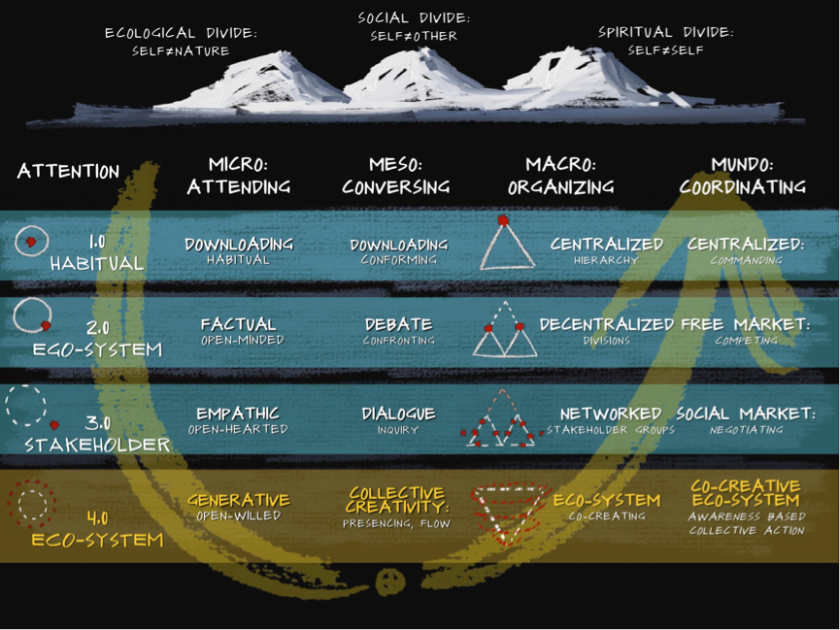

Otto Scharmer articulated very well the symptoms of the broken system:

- Ecological divide

- Social divide

- Spiritual divide

We don’t need to fix the existing system, we need another system. We need radical ideas for the new century: platform cooperatism could be the answer. But a lot needs to change.

Still inspired by Scharmer, we need to improve the quality of how we engage with each other, the way we debate, dialogue, coordinate, organize. We need to take into account the quality of the context. We need to go from experiments and prototypes to models that can scale and be transformative. And that needs to happen at an institutional level.

In his ULabs, Otto Scharmer has identified two missing conditions for this to happen:

- Enabling infrastructures that bring together the right set of players into a system

- Move from abstract coordination mechanisms (like hierarchy, markets or organized interest groups) to co-creating ecosystems

In the middle of the great transition from centralized to decentralized to fully distributed systems, we have a choice: we can copycat the models of platform capitalism leading almost by nature to a few monopolists who take it all, or we can choose for a construct that has in mind the flourishing of the whole, of the cooperative.

Somebody has to take up the role of the commons for financial services, where the end-goal is not to maximize profit and shareholders value, but the interest of the community and the maximalisation of flow between all the stakeholders.

Thank you for this useful perspective. It helps to focus my attention to where it will be worthwhile to play. Another notable piece may be “The Divine Right of Capital” by Marjorie Kelly.

Peter, it’s so interesting to see these ideas emerging in so many corners right now. I’ve not yet watched Douglas’ talk (but plan to). Thanks for the summary. Lately, I’ve been thinking a bit about Gig Economy Platforms as stepping stone to large scale technological unemployment. Mechanical Turk is especially interesting in that light, but do is Facebook’s M.

The main reason I wanted to comment, however, is to say his happy I am to see this growing focus on the fact that these systems are designed to extract value from stakeholders and concentrate then in the hands of shareholders. Marjorie Kelly does such a great job of taking that story in “The Divine Right if Capital.”

I recently decided to follow up on her research. I did a deep dive into Federal Reserve data to try to better quantify the scale of the extraction. Here’s part of what I found:

“When you combine dividends and corporate stock purchases, you get a huge stream of wealth flowing from corporations to shareholders. Over the last 30 years, this transfer of wealth from corporations to shareholders totaled an inflation-adjusted $17.474 trillion. Last year alone, dividends and corporate stock purchases transferred nearly a trillion dollars to shareholders.”

“Since the year 2000, this flow of wealth has amounted to an average 5.5% of the United States Gross Domestic Product – every year.”

More:

http://www.the-vital-edge.com/stock-market-concentration-of-wealth/