This is the last post in a series of four about the Innotribe Sibos 2015 programme.

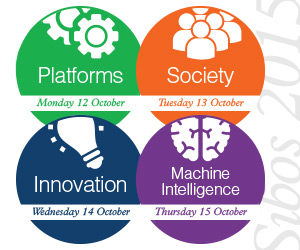

In a play of words on Kevin Kelly’s book “What Technology Wants”, we have four major themes this year, one theme per day:

- Day-1: What Platforms Want

- Day-2: What Society Wants

- Day-3: What Innovation Wants

- Day-4: What Machine Intelligence Wants

Day-4 is all about Machine Intelligence. We will showcase highly immersive demonstrations of cognitive analytics for a real-time world. The day will include sufficient critical voices on the impact of machine intelligence on the future of jobs and human / machine interaction.

Our anchor-person for the day is our own Jay van Zyl, Founder & CEO, Innosect.

Jay is all about Social Based Innovation: unlocking value in the social ecosystem requires a renewed look at how machine and human interact. He is involved with ground-breaking work in Silicon Valley, for example the Innovation for Jobs community lead by David Nordfors and Vint Cerf. His latest book “Built to Thrive, making your mark in a connected world” was published in 2011 focuses on the social aspects of innovation.

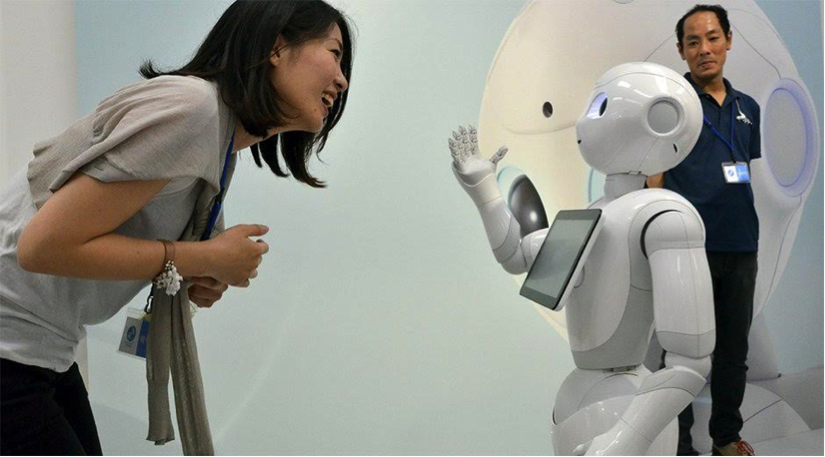

Usually, by day-4 of Sibos, folks get a bit tired, so we thought opening this day with something really cool. Starting at 09:15am – 10:00am on the Innotribe stand, our session “Accelerating and scaling expertise with cognitive computing from IBM Research and Watson” will showcase these new promising technologies in 360°! We will use the full real estate of our big LED wall to immerse you in mind-blowing demos of cognitive assistants, a financial sentiment aggregator, psycholinguistic features, and deep learning techniques. And yes, we will have the IBM Watson robot.

Video IBM Watson Engagement Advisor – check out robot at 1 min

After a short break, we’ll continue on the Innotribe stand at 10:15am – 11:15am with the “Voice of the customer 3.0”. In the old days, organisations tried to understand the voice of their customers through so-called customer focus groups. We have evolved a lot since then. In this session we’ll show you three examples of the 2.0 and 3.0 generations:

- Fidor Bank operates a highly participatory platform for customer and developer engagement in almost real-time

- Better Ventures will showcase how creating participatory experiences and at scale is now within reach of any financial institution.

- Innosect looks at the intersection of innovation and human capacity as our work on the idea-graph seeks to create the ultimate human-idea network.

The Innosect piece is a nice segway in to the next session at 12:45pm – 13:45pm, Innotribe stand “Thinking machines and jobs: How banks can respond to the opportunity”.

You will be welcomed by Pepper, the Aldebaran robot

Will robots steal your job? Check out this site from BBC news, to assess the likelihood that your job could be automated within the next two decades. But it is probably the wrong question. It’s a question grounded in a faltering narrative of a task-centered economy. We can do better.

That’s why we have invited David Nordfors, CEO and Co-Chair, i4J Innovation for Jobs who together with his partner Vint Cerf at Google are already thinking about the next stage: “If computers are going to do what people do today, what can people do?

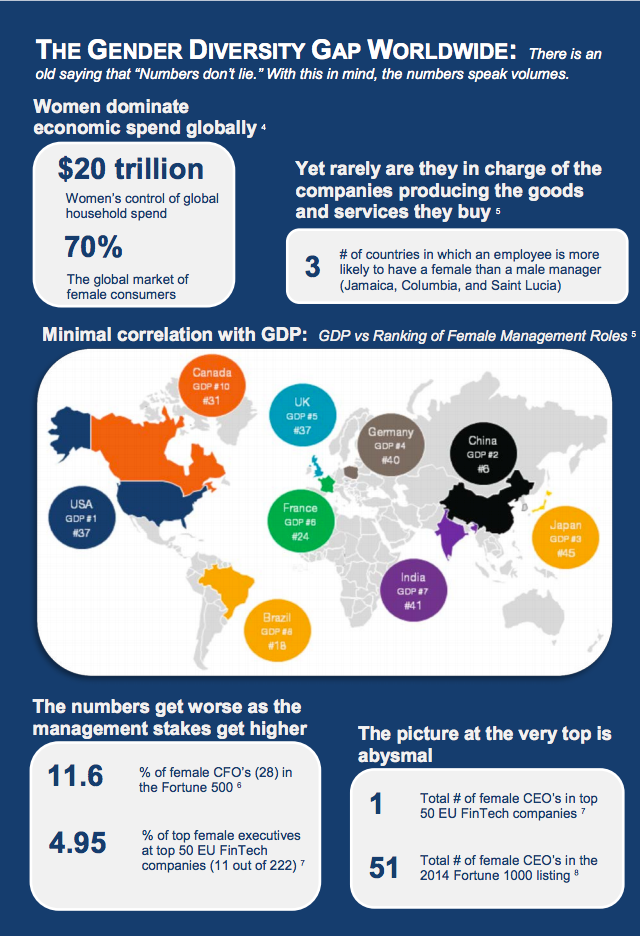

We will quickly change the dystopian “robots will kill our jobs” conversation into a “disrupting unemployment” perspective and weave in the views of Millennials from Wharton FinTech and the Singapore Management University.

At 14:00pm – 15:00pm, we’ll get a little more relaxed with a session labelled “Analytics for a real-time world” on the Innotribe stand.

Nevermind, we wanted to create a real demo nirvana, and have invited four data analytics and machine intelligence firms who will give amazing demos of applications that are currently in the market related to real-time financial services. I have seen some of the demos and how we are planning to stage this with the full real estate of our circular big LED wall, and this is something you don’t want to miss.

The Innotribe Sibos week comes to an end on the Innotribe stand with our closing session “Machines are not the answer”, starting at 15:15pm. We are very proud to have with us Andrew Keen, Author of “The Internet Is Not The Answer”.

There are many positive ways in which the Internet has contributed to the world, but as a society we are less aware of its deeply negative effects on our psychology, economy, and culture. Andrew Keen will debunk some of the enthusiasm surrounding what we take for granted in our on-line lives, and reflect on all that artificial and machine intelligence we have seen on this day-4 of Innotribe Sibos 2015.

Right after the Innotribe closing session, we all head for the big Sibos Closing plenary, with Ravi Menon, Managing Director of the Monetary Authority of Singapore (MAS). And later in the evening you are all invited to join the annual big Sibos party.

We hope you enjoyed this little series of posts familiarizing you with the Innotribe programme for this year.

We look forward welcoming you on-site and to see you part of our immersive learning experiences on platforms, society, innovation, and machine intelligence.

Other resources:

- Full programme on Sibos.com: https://www.sibos.com/conference/conference-programme/2015?field_session_stream_tid%5B%5D=466&op=Filter

- Also see my recent interview on Sibos.com “Innotribe and the future of FinTech innovation”

- Registration via Sibos.com: https://www.sibos.com/my/login

Bravery – the slide of the presentation. Source:

Bravery – the slide of the presentation. Source: