I was invited at the 7th Banking Innovation Forum in Vienna to speak on Innovation. The title of my talk was “Innovation: from tactics to strategy”

I have posted the deck on Slideshare

It was an interesting audience, with most people coming from Central and Eastern Europe, with some interesting case studies from Paolo Barbesino from UniCredit in Italy, Carlos Gomez from Activo bank in Portugal, Marcel Gajdos from Visa Europe Czech Republic/Slovakia, Efigence in Poland, and Wojciech Bolanowski from PKO Bank Polski. I made quite some notes, and if i find the time to make a post on it, i will.

Luckily, my fans are out there to help me. I planned write something about my talk as well, but Wojciech Bolanowski already did that in his great LinkedIn Post here. I have cut and pasted his post in its entirety, as it captures well what i was trying to convey in that presentation. Thank you so much, Wojciech, much appreciated 😉

+++ Start post Wojciech

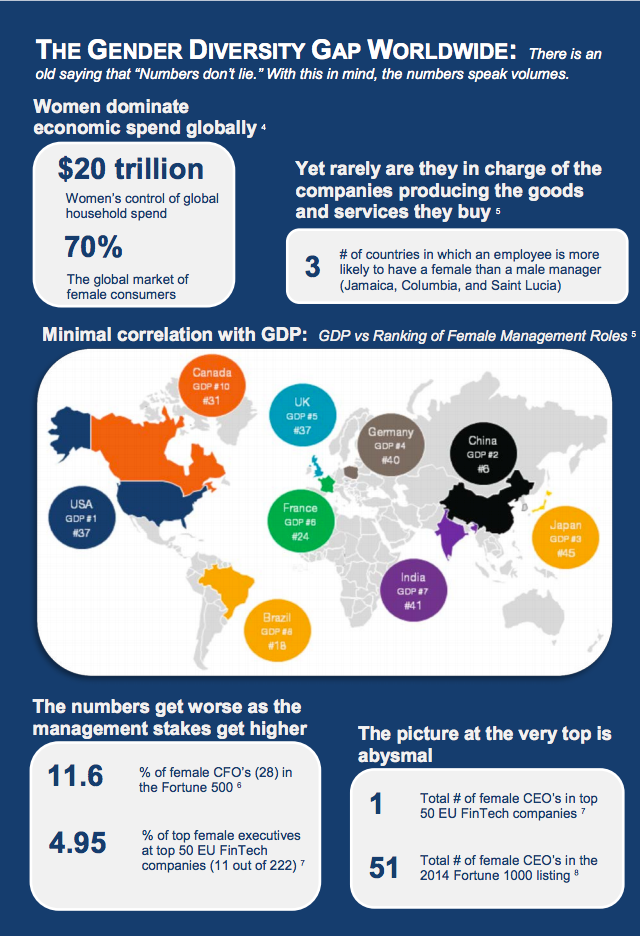

Inspire other people, think differently, create spaces where people come alive, ship to customers; as well as bravery, prototyping, events, capabilities and clarity – these are ingredients for successful innovation within big organization; at least according to excellent speaker and Innotribe Co-founder Peter Vander Auwera.

How to innovate in the shadow of behemoth?

Peter spoke on the first day of 7th Annual Banking Innovation Forum by Uniglobal in Vienna Marriott Hotel (as pictured above). He was keeping the audience extremely focused and interested. The subject was complex and of great importance: how to make really BIG organization innovative. As Peter put it in an outstanding rethoric figure: “how to make babies”. I would like to add: how to make the babies when you are well-known, established, serious and successful one with huge legacy and obliging history.

The questions are (usually) much more important than particular answers, so there is not my goal to report Peters’s solution in details. What I would like to point out is the question itself. Today, in the fast-running world of fin-tech start-ups and quasi-banking innovators almost every bank is big enough to raise this question to itself. Is it enough to inspire other people with your disrutptive ideas? Is such inspiring even possible in organization too big to change itself spontaneously? What could possibly happen if you think differently from dominant thinking styles?

Obviously, being innovative within mammoth-size organization is a big challenge and requires specific attitude and social skills. As I understood one of the Peter’s suggestion is to create appropriate team which become the centre and engine of the process. The brave, capable team with clearly set culture of “rather be failing frequently than never trying new things” to quote Peter’s presentation. Some important tools to do so are special workspaces, integrating events and ways of building true alignment.

Bravery – the slide of the presentation. Source: Uniglobal

Bravery – the slide of the presentation. Source: Uniglobal

How to gain executives’ support?

The presentation was full of insider stories with some of them concerning interactions between innovators and the board members. Those were a great lesson of struggle which, I think, at least to some extend, any innovator should expect and be prepared for. The very useful take-out was about prototyping and commercial launching of innovative products. The prototype should be, according to Peter’s best practice, as vivid and identical with the final product as possible. No more “Power Point Prototypes” unless you would like to fail. What’s even more – prototyping is just a step to the real strategic goal – to deliver real, commercial product and give it to customers. “Go out of the sandbox” is another great statement I heard from the speaker. Indeed, today environment of fast growing and alternating product propositions demand being “on market”. The Grand Jury of customers has no time to screen through pilots or prototypes; every company should be ready to risk and show its innovation as soon as it is delivered. In my opinion this is extremely important to realize. Shipment to customers what is already prototyped is the crucial part of execution process in innovation. I feel it is striking and true, therefore I tweeted this immediately with hashtag #BAIF2015!

What about the reluctant middle-level-managers?

The next splendid remark is about mid-level managers’ attitude toward change. For them the main goal is “too keep any changes far away of the plan”. It is understandable and rational. For manager’s KPIs are target-related, they try to keep organization on the course to achieve them. However, any innovation process within organization creates the risk of change, which, possibly, could alternate plans and goals. This is the real challenge – to execute innovation in organization which mainly consists of medium-level managers. And execution itself is much more difficult and lasts much longer than whole creative process of gathering ideas, evangelization, internal promotion etc. What Peter stressed, and I agree fully, is thatin context of big organizations idea management process is easier and shorter than its incubation and implementation. In start-ups world there is exactly the opposite relation.

Start-ups as indicators

Start-ups in financial sector (dubbed fintech recently) occupied a lot of Peter’s presentation as he is involved in the well-known Innotribe@Sibos program. The event has attracted more than 340 participants this year. It is quite nice sample to show what’s going on in innovation. With four continental semi-finals (NYC, London, Cape Town and Singapore) it gives global overview and prime selection of activities. This could be a useful indicator for big companies to track the start-up trends and pick up something valuable from. For example in 2014 the leading areas of start-up activity were (despite a broad category of corporates/business services) investment management, lending, big data and personal financial management. It is a clear message to banks: there is innovation coming to your core businesses and it is technology-driven.

This post is inspired by presentation shown on of 7th Annual Banking Innovation Forum ; there is another one of this category, in case you are interested:

Collateral damage of 2008 – card revenues in CEE

Peter Vander Auwera on stage in Vienna. Source: Uniglobal

Linguistic disclaimer

I have written this text in English and I know my limitations. It is possible you find this post illogical, offending, unclear or too simplistic. It does not mean to be that way, so please blame it to my imperfect English skills. I am neither native nor perfect English speaking person . If you want to be helpful, do share your grammar, spelling, style and any other remarks with me. I would appreciate any contributing comment, especially if it came from native speakers.

+++ End post Wojciech

Bravery – the slide of the presentation. Source:

Bravery – the slide of the presentation. Source: