For its seventh year, Innotribe at Sibos goes center stage! This translates into two components: first, some our most successful sessions of previous years go to the main stage: the Future of Money session and the Innotribe Startup Challenge Finale. Second, we are building an awesome innovation hub on the exhibition floor, next to the SWIFT stand.

On the outside, the stand is designed as a vibrant networking area, with exhibition demo stations for the Innotribe Startup Alumni and the late stage semi-finalists of the 2015 Innotribe Startup Challenge. And we’ll have the best coffee corner in town with real baristas.

Inside, the stand will host our circular workshop room. It’s already nicknamed as “The Blender” and has a magical 360° projection wall. This is where the majority of our sessions will take place.

As always, we will introduce the latest innovation trends, whilst delivering thought-provoking content designed to challenge perceptions. Together with global professionals from across the field of innovation, Innotribe will explore topics at the center of the financial services industry agenda in payments, market infrastructures, and the corporate landscape.

In a play of words on Kevin Kelly’s book “What Technology Wants”, we have four major themes this year, one theme per day:

- Day-1: What Platforms Want

- Day-2: What Society Wants

- Day-3: What Innovation Wants

- Day-4: What Machine Intelligence Wants

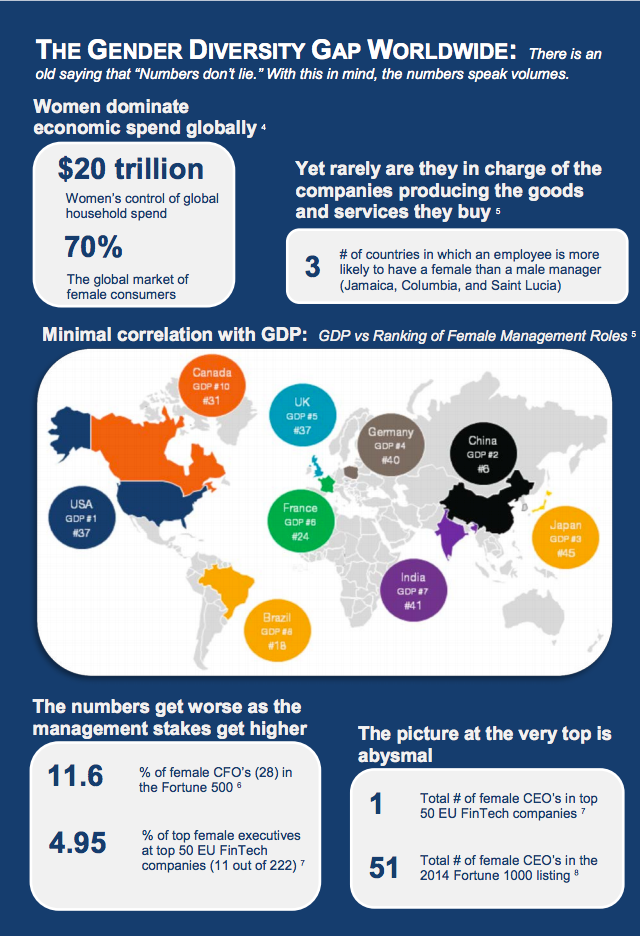

Across the four days, we have two big design principles: Millennials and Power Women in Finance who will be an integral part of all sessions in this year’s programme. We just launched two whitepapers to prepare us for Innotribe Sibos:

- “The Power Women in FinTech Index: bridging the diversity gap”, in partnership with Sam Maule from Carlisle & Gallagher Consulting Group and Christine Duhaime from the Digital Finance Institute.

- “The Millennial Generation and the Future of Finance: A Different Kind of Trust”, in collaboration with Daniel McAuley and Steve Weiner, co-founders of Wharton FinTech, the first student-led FinTech initiative.

As you may notice, we put a lot of efforts in ensuring diversity by having different thought leaders joining us in every session: men, women, millennials, investors, accelerators and contrarians. Whirling around the room with the different protagonists like in a real blender, we will create the right mix of topics and speakers and create an interactive environment for our audience. This year we also do special effort to integrate art and music in the overall design of all our sessions.

Next to this, the Finale of this year’s Innotribe Startup Challenge will see the 12 early-stage startups selected during the regional showcases pitching their pioneering products and services.

Innotribe is open to all Sibos delegates willing to drive change and embrace innovation for the benefit of the financial industry, by understanding its trends, opportunities, and challenges: business analysts, product managers, strategists, marketing/branding/innovation managers, transaction bankers, securities managers, corporates, standards experts, payment professionals, investment managers, regulators, policy makers.

Registration via Sibos.com: https://www.sibos.com/my/login

Full programme on Sibos.com: https://www.sibos.com/conference/conference-programme/2015?field_session_stream_tid%5B%5D=466&op=Filter

Also see my recent interview on Sibos.com “Innotribe and the future of FinTech innovation”

Bravery – the slide of the presentation. Source:

Bravery – the slide of the presentation. Source: