This blog post shares some more details about the Innotribe Health Index. This session will take place on Monday 29 Oct 2012 from 11:00 till 12:15 in the Innotribe Space. The overall Innotribe Program at Sibos is here, and I try to keep that post up-to-date with the very latest speaker and program announcements.

Whereas we are sure that the main conference will cover main topic areas and trends such as Global Shifts in Economic Power, Regulation, and the financial crisis, Innotribe would like to propose some alternative lenses based on New Economies and New Values thinking, aimed at accelerating a positive re-balancing.

The Innotribe Health Index is a brand new Innotribe initiative. Through six different lenses (Reputation and Sentiment, Social Data Capital, Big Shift Readiness, Technology Readiness, Urbanization and Inequality, and Agility), we will try to give an alternative ‘health check’ of the financial system.

The intention is that the Innotribe Index is an annual checkpoint, where this year we establish the baseline, and in subsequent years we look at the progress we make versus this baseline.

The effect we want to create is a bit like the famous “state of the union” update on Internet trends by Mary Meeker (who moved last year from Morgan Stanley to Kleiner Perkins Caufield Beyers).

Here is the data-avalanche presentation by Mary Meeker of last year at Web 2.0 Summit in San Francisco:

That went fast? Yes, indeed. Like a jet-airliner flying through your living room!

We will at least go as fast, if not faster. Indeed, this session is designed as a “high-speed” session.

Each igniter (that’s how we call our speakers) will give a power talk on their specific lens, and where possible come-up with a readiness index score from 1 – 10, giving a sense of the readiness of our community for that particular challenge. That’s six lenses in one hour!

Some background on our igniters for this session, and why we invited them to be part of this session:

Julius O. Akinyemi

Julius is the initiator of Unleashing the Wealth of Nations project and the Resident Entrepreneur at MIT Media Lab in Cambridge, Massachusetts.

The objective of this initiative is to effect a sea-change, a quantum leap for ordinary citizens of developing economies to move from day-to-day survival mode to a personal wealth creation and growth via asset ownership, registry, and mobilization.

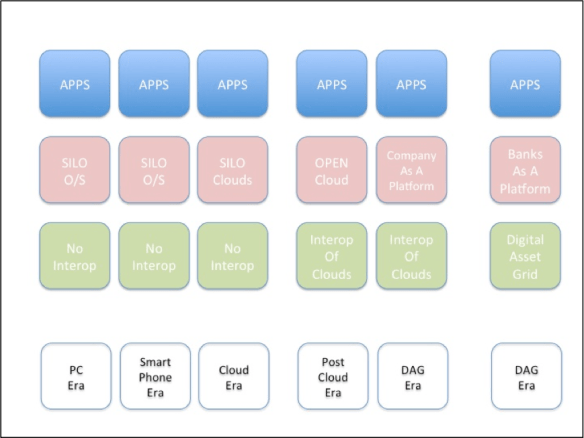

To unlock the wealth of nations, we aim to provide practical solutions tailored to the local environment that leverages the convergence of existing technologies. By registering people, their assets, and life events in an eRegistry, and through economic modeling, we will work to mobilize the currently dormant trillions of dollars in local assets in developing nations in order to generate local capital that fuels the economy via asset securitization.

Julius will come with a “Social Data Readiness Index”, as we see the availability of people’s social and identity data as one way to create financial inclusion. This topic will also be covered during one of the breakouts of the Digital Asset Grid session to showcase that unlocking data assets has an important role for the bottom of the pyramid.

Wouter De Ploey

Wouter is Director in Business Technology Office, McKinsey & Company.

He will present results of research done by the McKinsey Global Institute on global economic trends, including urbanization, resource markets, capital markets, and productivity and growth, with a focus on Asia.

- The landscape for supply/demand of labor is changing dramatically: where are the jobs for skilled/unskilled workers? Is the inequality in wages going up/down?

- More and more people live in cities. Urbanization is driving a lot of growth. McKinsey identified 450 emerging market cities. Capital follows activity. Access to capital gets tighter and more localized. Do banks have the right local footprint?

“What’s the readiness of banks to confront these meta-challenges?” is the subject of this lens.

John Hagel

John is Co-chairman, Deloitte Centre of the Edge. He very much supports out-of-the-box and catalyst new ways of thinking. That is for sure one of the many reasons why John is one of the enablers for the Innotribe incubation activities.

John writes regular for HBR, on his own blog, and has published several book. His latest “The Power of Pull” (Amazon Affiliates link) has become a business classic, where John highlights how we move from Knowledge Stocks to Knowledge Flows.

This shift is also at the basis of the Big Shift Index that Deloitte’s Center for the Edge has developed to provide a clear, comprehensive, and sustained view of the deep dynamics changing our world, and what companies can do to address them.

The Big Shift Index consists of 3 indices and 25 metrics designed to make longer-term performance trends more visible and actionable. You can download the Big Shift Index here (PDF file)

We are very proud of having such a thought leader as John Hagel with us at Innotribe Sibos to present the Big Shift Index. You don’t want to miss John’s authentic take on this fascinating subject.

Michael Jones

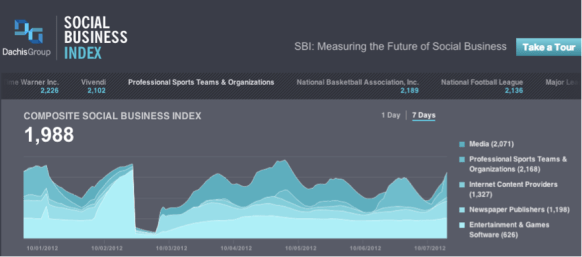

Michael is VP of Technology, Dachis Group. We have invited Michael to present the Social Business Index.

This index is built on top of Dachis Group’s Social Business Intelligence Insight Platform, analyzes the effectiveness of strategies and tactics organizations employ to engage the market through social channels.

The Social Business Index analyzes signals from over one hundred million social sources globally and analyzes the performance of the largest global companies and thousands of those companies’ brands. The Index is generated through the use of natural language processing, semantic analysis, and machine learning algorithms.

Think about it as a machine learning engine.

Michael will do a drill down on the data they have available on financial institutions.

William Saito

William is Founder & CEO, InTecur, K.K.

He is an entrepreneur, venture capitalist, public policy consultant and educator who has founded start-ups, managed corporations and worked on global information security policy over the past two decades.

To build entrepreneurial spirit in Japan, Saito also acts as CEO for the Innovation Platform Technology Fund (IPTF), a venture capital fund established by ex-Sony CEO Nobuyuki Idei and Kazuhiko Toyama, the former COO of the Industrial Revitalization Corporation of Japan (IRCJ). The IPTF seeks to produce more successful global ventures in Japan by creating a genuine venture environment.

Saito is active in several roles with the World Economic Forum (WEF). In 2011, he was named a Young Global Leader.

He is also Chief Technology Officer (CTO) of the Fukushima Nuclear Accident Independent Investigation Commission, the first such commission ever appointed by Japan’s national legislature.

With his strong entrepreneur role and his extra-ordinary international perspective, we have asked William – who now lives in Japan – to come up with “The William Saito Index”, an index reflecting agility readiness in financial services.

It will be a very personal take reflecting on entre- and intra-preneurship, in Japan and globally.

Michell Zappa

Michell Zappa is a Berlin-based technology futurist who has spent part of his life between London, São Paulo, Stockholm & Amsterdam.

His work, called Envisioning Technology, focuses on explaining where society is heading in the near future by extrapolating on current technological developments.

His research facilitates understanding the field for those who work in technology by painting a bigger picture of where the landscape is heading. In this, he tries to guide both corporations and public institutions in making better decisions about their (and society’s) future.

I met Michell through a tweet that was forwarded by one of my followers. Once we connected, we immediately spotted a fantastic opportunity to describe the readiness of financial institutions through an amazing interactive infographic. As we get closer to Sibos, we’ll release some pre-views of these amazing insights.

Coming soon: previews of Michell Zappa’s infographic on technology readiness of banks: short, medium and long term.

Michell has really surprised me with his fresh take on technology readiness, and I am very excited by the work-in-progress that I have seen from him in preparation for this session. Next year, I would love to give him a full hour.

So, in summary, fasten your seatbelts for this “faster-than-light” session, were you will be immersed in the readiness of financial institutions based on six different alternative lenses.

See you all in Osaka! Monday 29 Oct 2012 from 11:00 till 12:15 in the Innotribe Space.