On 14 May 2013, the Innotribe team is organising an exclusive invitation-only Innotribe Workshop at Level39, Canary Warf, London. The topic of this workshop is “Network Insights for business growth”.

This workshop is targeted at senior strategists who would like to discover how big data and scenario thinking can lead to early warning systems and new network insights to assist in business growth strategies.

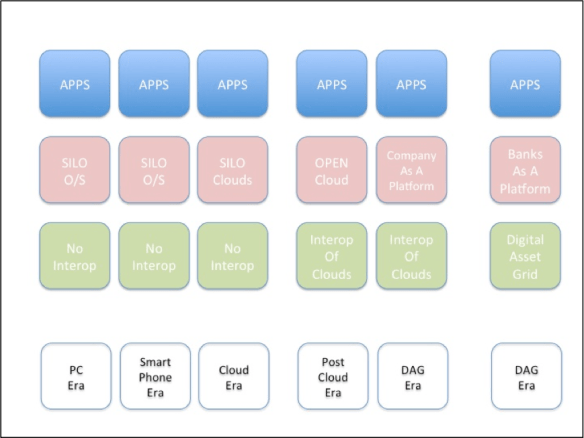

Your organisation is indeed hyper-connected with your business partners. You are not alone. Billions of connected business, people, applications and devices and in future far more sensors, and transactions now add up to create unimaginable amounts of information. This new environment will require extraordinary insights and adaptability: It is as if we are a species from dry land that has to learn to live in the ocean. Already now, we swim in a sea of data and the sea level, so to speak, is rising rapidly. This new environment requires a new design for companies and network insights, representing both threats and opportunities.

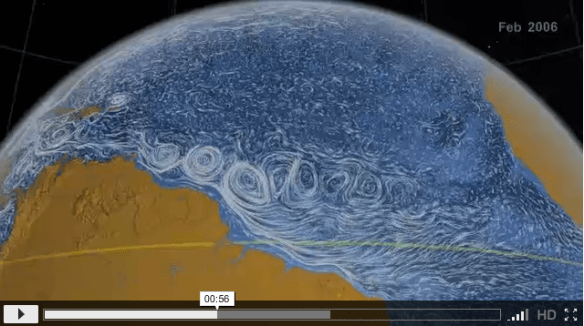

The networks that we are part of can be looked at as dynamic fluid systems: the infrastructure of pipes creates a hyper-connected environment. The end-points in networks can be different entities: financial institutions, corporates, and market infrastructures, etc. And physically wired networks can host many different functional sub-ecosystems: some represent major traffic highways, others are more hub-to-hub topologies, others function as pure peer-to-peer exchanges. These different entities and sub-ecosystems also influence each other: they create “ripple effects” up and downstream, as well as “currents” that create significant interdependencies, like ocean currents.

During this exclusive invitation-only Innotribe workshop, we will explore the following topics:

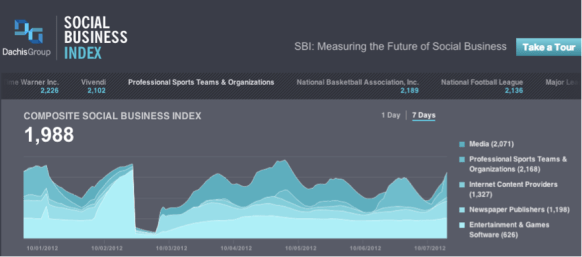

- What if you could get deep intelligence about what’s going on in these fluid networks in real-time?

- How could that inform your growth strategies, long term scenario planning and policies?

- What if you could combine quantitative and qualitative network intelligence streams, and combine them with scenario thinking into real insights and possible early warning systems?

- How can you use network insights to inform your future scenario planning and strategies for growth?

- How we use these insights for better informed risk management policies?

“Network Insights for Growth” will be organized in the authentic Innotribe-way. We will bring together thought leaders in highly interactive conversations, facilitated by the renowned Innotribe team. In this year’s Innotribe events and workshops, we also try to limit the number of subjects covered, so we can experience deeper conversations and insights.

This “Network Insights for Growth” event will he held at and in collaboration with Level39, Europe’s largest accelerator space, where technology, accelerator and innovation companies are being invited from around the world to come and run their startup and accelerator programs, in one of the most inspiring spaces in London. Situated in the heart of one of the most advanced ‘smart cities’ in Europe, Level39 occupies the entire 39th floor of Canary Wharf’s iconic One Canada Square.

We will start at 10:00am UK on 14 May 2013 with planned closure of the workshop around 4pm UK. With plenty of informal networking opportunities and informal conversations during the networking breaks and lunch. This event is free-of-charge.

If you like to attend this exclusive workshop, please contact me and I will get you your personal invitation. Number of seats is limited.

Looking forward to continue our critical dialogue in London on 14 May 2013.

Detailed program:

10:00 – 10:15 Welcome and Introduction

- Fabian Vandenreydt – Head of Markets Management and Core Business Development – SWIFT

10:15 – 11:45 5 different lenses (15 min talks by)

- Kimmo Soramäki – Founder and CEO – FNA (Financial Network Analytics)

- Daniel Erasmus – Owner – DTN (Digital Thinking Network)

- Simon Small – President – Arria NLG (Natural Language Generation)

- Walid Jelassi – Transformation consultant information management and analytics – Hewlett Packard

- Anant Jhingran – VP Data Strategy – Apigee (tentative)

11:45 – 12:00 Break

12:00 – 13:00 Interactive workshop

13:00 – 14:00 Lunch

14:00 – 14:30 Taking Stock

14:30 – 15:30 2nd Interactive Workshop

15:30 – 16:00 Conclusions, next steps and wrap-up

We plan to continue the conversation on this topic during this year’s Innotribe@sibos in September 2013 in Dubai. During the May workshop in London, we hope to establish a solid baseline as a stepping stone for our in-depth sessions on “Scenario Thinking” and “Network Insights” in Dubai. Earlier this week, i posted a preview of our 2013 Innotribe Sibos program.