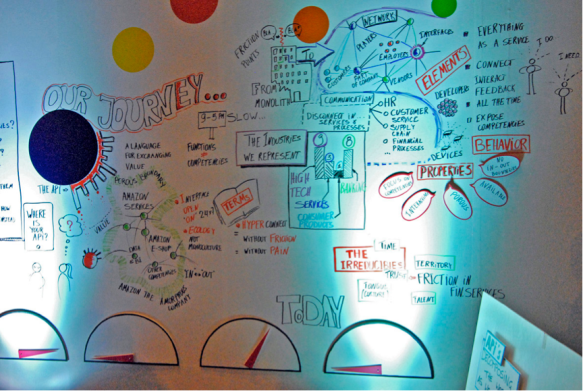

I am just back from the #disruptiontour with tour leaders Peter Hinssen https://twitter.com/hinssen and Steven Van Belleghem https://twitter.com/StevenVBe, and flawlessly put together by tour organizer Ilse Debondt from Connected Visions (https://twitter.com/ConnectdVisions ).

The PDF of the full program can be found here: http://www.connectedvisions.eu/pdf/cvdtour_program2014.pdf

I have made two blog posts about this excellent study tour:

- “Highlights Disruption Tour” with a sequential overview of highlights per company visited (this post)

- “The Uberization of Everything”, a more holistic analysis and sensemaking effort of what I believe are the disruption understreams.

The tour started in the Bay Area on Monday 2 June 2014 with a visit to Google and ended on Friday 6 June 2014 at Scripps Research in San Diego.

In chronological order, please find below some highlights in telegram style with my 100% subjective views for which I am 100% responsible 😉

Google https://www.google.be/intl/en/about/

Google Play marketplace is cross platform. Focus on avoidance fragmentation Android platform. Focused on monetization developers, OEMs, Carriers, HW device manufacturers with “lead devices” launching new versions of android. “Interesting” to see that focus and monetization is on ecosystem, and not end customer. Trends: everything going mobile and multi-screen

Next:

- Android beyond phones and tablets’, TVs, cars and wearables

- Voice based search, and not only one way search but also leading into CONVERSATIONS

- Car display as remote display for your phone

- OS for the rest of the car, cars have much longer life cycles, how do we keep innovating?

- Wearables: same strategy of platform, specific versions of android, skimmed down versions

- Enterprise, “android at work”, with specific focus on security

Brand: speaker acknowledges that he does not know anymore what the Google brand is standing for…

Google Glass https://www.google.com/glass/start/

We had opportunity to “play” with Google Glass. Some disappointment as far as I am concerned. Needs much more value prop. Baffled that some folks pay 1,500 USD for this.

YouTube https://www.youtube.com

Metaphor Switzerland vs India: Switzerland, cost of entry high, lots of barriers, everybody follows the rules; India, the opposite: low cost of entry, less barriers, no rules. Video is like India. Astonishing volumes of videos on YouTube. YouTube is the new search for Millenials. Little control what is watched. Organize for variation. Cost of production and distribution drastically down. Biggest learning: from “audience” to “fan-base”. However, still talking in terms of “targeting the right adds to the right “audience”, not fans (sics) > not eating their own dog food

Khan Academy https://www.khanacademy.org

Mainly focused on math courses, some other categories emerging. Interesting: more focus on non-cognitive aspects coming: fear of math, fear of success, how to build confidence. Disrupting education: teachers become fellows/coaches

Tesla http://www.teslamotors.com

Wow! I was almost in a shock when entering the industrial the open office space (no pictures allowed inside) of Tesla in the ex-Toyota manufacturing plant. Really feels like pigeons in open cubicles. Before complaining about your open office space, first have a look at this one. From 600 to 6000 people in 3 years, and 6000 more this year. Presenter and head of supply chain: “The first 18 months were brutally tough”. The vehicle is a software platform, every car is a connected vehicle, over the air software upgrade of the vehicle. Burning 100m USD per quarter!!! Mission is about “transporting human beings” and caring about the customer: “somebody is looking after you” > we call them pro-actively in their car… “We want to transform the automotive industry into sustainable practices”

The key thing for Tesla is driving he revolution, self driving vehicles are coming much much faster, and the future is one of no combustion engines, self driving, full connected vehicles.

Biggest eye-opener: the people at Tesla are more proud and more engaged than the Google folks. Also here: fighting regulation of retail structure of dealerships, and fighting regulation requires deep pockets

23andMe https://www.23andme.com

Who gets money of making sure people do NOT getting sick. Towards “data ethical organizations” and personalised medicine. Google-like big data principles applied to genetics. FDA update: “FDA was more concerned with The INTERPRETATION of The data”. Embraced the process of FDA regulation > will be very beneficial for us!!! The only one standing FDA approved one… “going through the regulation process makes you stronger, but required deep pockets”. Research: ONE big aggregated database: shared (against fee) with pharma research, even with P&G > makes me feel very uncomfortable. Do I have the right to be forgotten in the aggregates data pool of 23andMe?

Paypal http://www.paypal.com

Mobile, mobile, mobile. Target, target, target. Get in, get out, any currency. Next target, move bodies and shopping. In shop cameras, sensors, real time, creepy. Fascinating how easy they say “what the heck, it’s cool…” shop more efficient, immediate satisfaction. Making payments invisible. ONE hour delivery in Manhattan.

Cross “method of value”, anything in, anything out. They were avoiding my question about supporting crypto-currencies, although their (now ex-) CEO Marcus seemed to open the door. Marcus is now with Facebook….. Online and offline. Blurring into the OFFLINE physical world

PayPal Beacon: It’s a tracking and checking device handsfree. “You have been “tagged”

Cross merchant payment profile: “It’s creepy but we will get over this”

Very nice showroom/lab: User experience looks more and more like “Spotification” of commerce information stream. Payment becomes invisible aspect of commerce experience

Palantir Technologies http://www.palantir.com

Had very high expectations. Awesome opening presentation by Ari Gersher, #9 non-founding employee of Palantir

- AI and chess: “weak human plus weak machine plus better interface beats the grandmaster”

- Human machine symbiosis

- Engineering all the friction between human and machine

- A “synergistic system” for decision making

- “Just works” experiences for enterprise, like what Apple did for consumer

- We can build Facebook in one day

- HR: Seniority does not encompass competence

- 40% is government work

- Data integration in 8 weeks in stead of 5 years, anecdote of McKinsey brain just incapable of taking in this sort of time disruption

- “Nuanced analysis” > love the vocabulary

- Have a philanthropic engineering team

- Do things not because the law, but because it is the right thing to do

- Working on changing IT purchasing in government

- “We have learned that you don’t sell to a government, you sell to a budget”

- Great metaphor, comparing Hadoop to engine block and LeMans car race with team of 120 people…

- Doing UX is always hard: have team of 20 product designers for UX > UX is major capability for 21st century

Demo section of visit was disappointing. A lot of the demo videos on their website are much more convincing. A missed opportunity for Palantir.

- Cyber crime demo, Turn around exploits in 4-6 hours, 1-2 TB per day digital exhaust

- Credit card processor demo: 100 billion data points, “fluid” data exploration, showing their Valhalla application

Singularity University http://singularityu.org

On NASA Research Park, Moffet Field. Old building. Glasses, drones, genome, and other over glorifications of technology and abundance. Missing the critical dialogue here. Referring to CIA TED video about ethics > how cynical can you get post Snowden? Interesting: spokesperson herself does not believe in a singularity one single moment… “Singularity University is not about the singularity and not a university”, another brand identification issue. Singularity University is also and incubation space for startups/companies. “lots of ethical stuff about all that, but… Anyway…“

Scanadu https://www.scanadu.com

Quick visit and chat with Samia from Scanadu, who have office in incubation space of Singularity University. Lots of issues to solve with regulators. Almost forgot the story/narrative of why Scanadu was started > narrative is so important

Coursera https://www.coursera.org

One of the highlights of this tour. Very impressive track record in only 2nd year of existence. Quality education at scale. Peer assessment is as good as teacher assessment

- From lectures to high quality feedback loops

- From audience to fan-base

- From audience to peer-base

Specializations: Capstone project, apply in real world project. Sponsorships by corporates for specific curriculum possible

Stanford Faculty Club panel discussion http://facultyclub.stanford.edu

About corporate Labs/Outposts in Silicon Valley. Btw: Vodaphone just closed their InnoLab in Silicon Valley

Panel discussion introduced by Mark Zawacki http://www.650labs.com/team-member/mark-zawacki/ of http://www.650labs.com with Todd Schofield from Standard Chartered Bank Studios and Ursula Oesterle from Swisscom

- Todd also spearheads a group of 20 banks that have presence in Silicon Valley

- Swisscom have 4 people, most rotating, projects-based, looking into foresights, insights, actions

o Common themes

- Corporate needs to sell to startup and not the other way around

- Stop, go, stop, go,….you lab activities: the worst things you can do to your brand and reputation

- Remote silicon valley labs only work if you have high quality alignment at exec level

Ripple Labs https://www.ripplelabs.com

Presented by the awesome Patrick Griffin, who was at Innotribe Sibos 2013 in Dubai last year.

Excellent presentation:

- Peer to peer exchange of currency

- It is a settlement system, it is not a payment system

- Bitcoin is single currency Ledger (the currency is Bitcoin), Ripple is multi-currency

Ripple is attacking the correspondent banking space.

Ripple super-sweet for SWIFT, talking about “complementarity” although difficult to believe this is not disruptive for SWIFT. Positioning Ripple as “complementary” to SWIFT. Sending swift messages on top of the ripple layer.

StockTwits http://stocktwits.com

Founder (now Chairman) Howard Lindzon was already at Innotribe Sibos in Toronto in 2011. I know it’s a great company, but our presenter was Chris Corriveau (CTO), who apparently just left the company.. Interesting to see other end of spectrum of somebody who has run out of energy and motivation. Had lot of funding: “4M here, 4M there….”, Lots of funding, but no clear direction: “Throw stuff and see what sticks “. New CEO comes from media, stock tweets seen as media. Personal aha moment: “Social IS media”

EvoNexus http://www.commnexus.org/evonexus/

No strings attached high tech incubator Www.commnexus.org. 30 startups now in incubation. “Wet lab, dry lab” > only dry labs. Started in 2009.

Feeling of me too old, they too young

Here is their International Business Development Manager

What’s special? Free for startups. Tough to get in. No board seat, no equity, and no legal oversight. Can kick you out if no progress shown. All buildings owned by Irvine Company, largest property owner in California. Provide this completely free, growing next generation of tenants. “An engineer can always reinvent himself, a banker not”

Liked the Timeline for managing the startups

Janssens Labs (Johnson and Johnson) http://www.janssenrnd.com/our-innovation/partnerships/janssen-labs-at-san-diego

Without doubt the absolute highlight of this tour.

Wow, what a campus!!!! Corporate Credo in welcome hall. See PDF version here: http://www.jnj.com/sites/default/files/pdf/jnj_ourcredo_english_us_8.5x11_cmyk.pdf Here is an extract:

Our host is Diego Miralles, Global Head Innovation at Janssen. Very impressive. Walks into room, says hello, and gets right into the subject, and entertains audience for 1 ½ hour without slides. Absolute magic!

- Story of Janssen Labs is story of shared infrastructure

- Life sciences is very different from tech, you need a lot of infrastructure, highly regulated, etc > so many parallels with financial sector

- “we should all be humble , there are a lot of smart people in the world”

- Money in healthcare is almost exclusively made in the presence of disease > this business is highly dysfunctional

- The current system of medicine is based on healer having all the knowledge and the recipient

- The system is so vested, the problem is not technical, it is societal

- The idea of fee for service in this business is the problem, based in volume, based on keeping the status quo of the system > a lot of parallels with financial services

- The regulator is not evolving: too much focus on preventing harm vs. enabling progress

- We a getting old too > you have to refill your organization with mentally young healthy minds for sustained innovation

- Beware of entitlement

Qualcomm http://www.qualcomm.com

This was new territory for me. Huge campus, huge company. Qualcomm can best be summarized as “the Intel for Mobile”? 5B USD last year in R&D. Vibrant partner ecosystem, like Microsoft, but for device design. 4 focus areas: energy, infrastructure, transportation, government. Look at things that are IP-addressable . 8B smartphones to be shipped 2014-2018. Smart Cities Connectivity has to be heterogeneous. Thinking through the longevity of connectivity. Decision making in cities is a mess: 40 different city departments making decisions about city connectivity. Also in Cars and in metering. Cities getting afraid of being punished for NOT doing anything with the data collected. Interesting how longevity of infrastructure is so important in this business

Qualcomm Museum Tour http://www.qualcomm.com/about/buildings/museum

First Kindle is in museum as item #30. In overview of smartphones, the timeline starts in the year 2000

Scripps Research http://www.scripps.edu

When we came in, we all got a copy of the book “Creative Destruction of Medecine”, just to set the scene 😉

First part of presentation was relatively basic with Airbnb, Uber, Mobile, etc. Surprised to hear that 40 USD for a 15 min doctor appointment is seen here as progress. Key message: monitoring you see today in hospital emergency room will soon be available on your wrist: blood pressure, ECG, Physical exam, house calls can now all be done with mobile device.

End

This was just a chronological overview of the Disruption Tour. See also my blog post “The Uberization of Everything” for some transversal sensemaking.