This post is a fifth in a series on personal digital identity. Part-1 “The unpolished diamond was published here in August 2010 and Part-2 ‘The Digital Identity Tuner” was published here in September 2010. Part-3 “Personal Data Something” was published here in December 2010. And part-4 “Austin-Munich-Toronto” was published in February 2011 here.

Drawing by Hugh MacLeod (@gapingvoid) during the Innotribe Deep Dive on Digital Identity, Sibos Toronto, September 2011.

That was February 2011. Since then a lot happened. I had so many rich discussions, met so many new fascinating people, and have been aroused by a deluge of new ideas on digital identity. And my employer SWIFT gave the go-ahead for an incubation project on Digital Identity that is now called the “Digital Asset Grid”.

As I mentioned in my Innotribe Sibos report, the Digital Asset Grid (DAG) is important because:

- We are moving from money bank to digital (asset) bank

- The DAG is an infrastructure play for SWIFT to offer a certified pointer system pointing at the location of digital assets and the associated usage rights

- It’s and economic imperative for SWIFT to expose its core competence via API’s

- The DAG is a huge opportunity for SWIFT to be a key infrastructure player in offering an end to end hardened infrastructure and end-point to enable the seamless exchange of any sort of digital asset between any number of entities

- This is also a huge opportunity for financial institutions to plug-in to this infrastructure for offering a new set of services in the data leverage space in un-regulated data market places

For me Digital Identity is so much more than your log-in, or our account-number that is backed by a Know-Your-Customer (KYC) process, or another userid/password or a security token.

I look at it a spectrum. Like you have a spectrum analysis for a star that uniquely identifies it, you can imagine a spectrum for the digital identity of persons:

Digital Identity Spectrum is everything from PKI, account#, Log-In to address, attributes, history, preferences, biometrics, reputation, risk profile, intentions, signals, etc and all this in transaction and time context.

It’s no co-incidence that Facebook recently announced “TimeLine”. Identity in time-context leads to your identity spectrum that is unique at one given time. And yes, you will be able to play it backwards like a movie, but also forward to do trend analysis and forecasting.

VRM (Vendor Relationship Management) is about sharing specific parts of my spectrum with specific vendor(s) in specific transaction context(s). In the Digital Asset Grid project we asked ourselves:

“What if we could apply the VRM principles not only to personal data but to any content, to any piece of information, to ANY digital asset?”

You could then start thinking about sharing specific parts of any digital assets with specific vendor(s) in specific transaction context(s).

In essence, what we are doing, is “weaving” digital contents with associated digital rights and who has the rights to that content.

It’s a map of digital weavings

of digital fabrics

This is how the Digital Asset Grid was born.

Is this not too consumer oriented for an organization like SWIFT? I believe this is the wrong question. The discussion “consumer vs. enterprise” has kept us blind. Same by all sorts of other customer segmentations like “small-medium-large”. In the identity ubiquity game, all this is segmentation is irrelevant.

We have to start thinking in terms of different sorts of entities that participate to the identity-dance. Those entities can be:

- Person (humans)

- Loose group of persons (for ex Google Circles), that have no legal construct

- Commercial companies

- Non-Profit companies

- Governments

- Educational institutions

- Programs (code)

The last one – programs – is quite fundamental. We are witnessing the blurring between humans and computers. It smells like early singularity. And in this debate we should not only be concerned on how programs augment humans, but also how humans augment programs. But that is another more philosophical discussion, and some good reading on this can be found in the book “The Most Human Human” by Brian Christian. (Amazon Affiliate link)

Back to our Digital Asset Grid…

The vision of the Digital Asset Grid

is to move the SWIFT network and SWIFT services

from a closed, single-purpose, and messaging-based system

to an open, general-purpose, API-based system

It’s a natural evolution. That’s it. No disruption. No—“the next big thing.”

Just apply out-of-band our core competency to the modern age of connectivity. Instead of destabilizing the market by disruptive innovations, provide the basic infrastructure missing for a global transaction-based platform on the Internet.

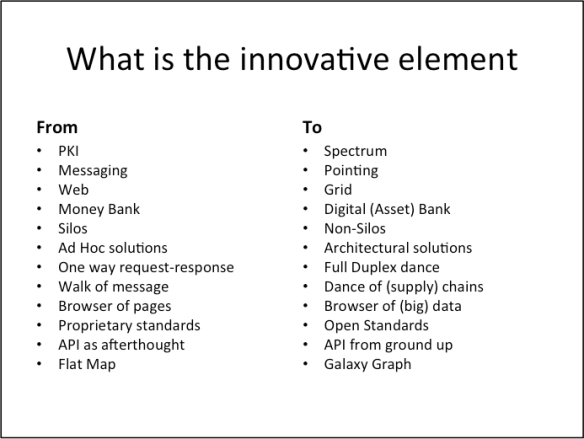

Of course, its vision is grand, with plenty of innovative elements and thinking. Here are some examples how we move from the traditional identity “space” to the new “Digital Identity Grid”

I would like to zoom-in on one of the bullet points above: from one way request-response to full duplex dance.

The web – a collection of pages – is based on some simple request-response mechanisms. I request a page and the server responds and gives me the page. End of that transaction.

With the dataweb – a collection of Digital Assets with associated usage rights – we will need something where exchanging entities can perform a dance around and with the Digital Assets. And we want to be sure that they are who they say they are, and that they have the right usage rights to the digital assets. So we move from a two dimensional view of the world (in computer terms a “table”) to a multi-dimensional view (in computer terms a “graph”)

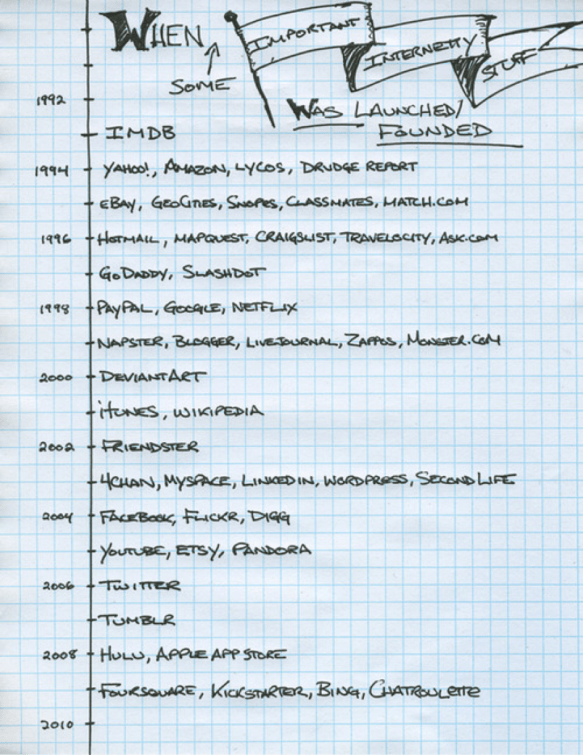

The Digital Asset Data Web is the next phase in the evolution of important internet stuff. It’s probably what comes next in the following series:

To continue the dance metaphor, the SWIFT infrastructure is the Dance Hall where entities meet to perform certain specific dances.

One of the many use cases for the Digital Asset Grid would be to solve compliance, In stead of moving messages from A to B, we keep the data where they are and “point” to them with SWIFT certified pointers to where the data are located and the associated usage rights.

The dance protocol (full duplex) for this use case, from opening of the dance with (a “webhook” in technical terms), to the actual picking-up of the content, and closing the dance and everything in-between, could look like something like this:

- PartyA: “hey, I am sending a signal that I wanna dance the tango (slang for payment instructions) with any party in the Swift dance hall at 9pm”

- PartyB: “yep, I wanna dance with you, let’s meet in the SWIFT dance hall at the bar”

- PartyA: “ok, here we are, cool place ;-)”

- PartyA: “Let’s get to business”

- PartyA: “I just gave you following rights my payment instructions at this XRI: you have XDI pick-up rights”

- PartyB: “ok, gotja. Will pick it up right away”

- PartyB: “knock knock, I am coming to fetch those payment instructions”

- PartyA: “let’s check if you have the usage rights….”

- PartyA: “everything looks fine, go ahead”

- PartyB: “loading, loading, loading…”

- PartyB: “Ok I am done”

- PartyA: “So am I”

- PartyB: “tomorrow, same place same time to dance ?”

- PartyA: “would love to 😉 9pm again ?”

- PartyB: “sure, bye bye”

- PartyA: “bye bye”

And, what’s really cool about it, it’s fully auditable, end-to-end.

When telling this story to one of my colleagues, I got the following reaction: “Hey, but you are changing the basic messaging paradigm of SWIFT… I am not sure that I want to support an innovation like this… one that is cutting off the branch from the tree I am sitting on…”

Here is something essential for innovation. Any innovation team in any company should not only look at some nitty-gritty small incremental innovations, but

daring to be great and to re-think

the cash cows of our companies

Like Guy Kawasaki used to say: “the best way to innovate is to set-up a company that is trying to kill your cash-cow”

All the above is about the infrastructure story that SWIFT could play in and in that sense is a bit navel staring. But the biggest opportunity however in all this is probably for banks, financial institutions, and new upcoming innovative financial service providers.

This is a HUGE opportunity to offer new digital services in non-regulated markets

Many examples and use-cases here :

- Personal Data Lockers, Digital Asset Lockers, Digital Asset Services aka Digital Bank, « Who-touched-my-data » services, Personal Data Trading Platforms, Digital Asset Trading Platforms, Corporate and Bank Klout Services, Audit services, Tracking services, Big Data and Analytics services, EBAM, Corporate Actions, etc.

- Also e-Wallets of all kinds. Not only « wallets » for money but wallets for all sorts of Digital Assets. An e-Wallet is nothing else than a browser on a personal money store. What if we start thinking a browser for a personal data (asset) store?

- And I spoke recently to one of our managers in Securities Business : also there plenty of examples, even in looking at trading assets.

So far, the Digital Asset Grid was just the result of a research project at SWIFT. Today, I am very pleased to announce that the SWIFT Incubation Team just gave the green light to move this project in prototype stage.

It means that during Q1 2012, we’ll have a working prototype targeted at a specific use case, but we will expose the API’s of the infrastructure and give them in the hands of developers and challenge them to come up with some cools apps that can be built on top of this infrastructure.

A lot of the thinking in this blog is the condensation of a lot of teamwork of many many people who participated to this Digital Asset Grid project. With the risk of missing out somebody, I’d like to send out a digital invitation signal to those people for a thank-you dance in the SWIFT Dance Hall: Mary Hodder, Kaliya Hamlin, Doc Searls, Drummond Reed, Craig Burton, Andreas Weigend, Gary Thompson, Tony Fish, and also lurking-in Don Thibeau, Scott David, and Peter Hinssen.

I would like to say Thank you! Maybe with David Bowie’s 1983 hit “Let’s Dance”? http://www.youtube.com/watch?v=N4d7Wp9kKjA

Let’s dance put on your red shoes and dance the blues

Let’s dance to the song they’re playin’ on the radio

Let’s sway while colour lights up your face

Let’s sway sway through the crowd to an empty space

If you say run, I’ll run with you

If you say hide, we’ll hide

Because my love for you

Would break my heart in two

If you should fall

Into my arms

And tremble like a flower

Pingback: Digital Identity: Buzzuminar with Dan Marovitz « Petervan's Blog

Pingback: 2012: my boss wants me to dance! « Petervan's Blog

Pingback: The future rarely arrives when planned « Petervan's Blog

Nice blog. This second read-out helped understand better what DAG (the day in Dutch 😉 is all about, compared to when it was presented in one the previous brown bag sessions. Hope to even learn more on Monday 02 April.

Thx, Jules. What is on 2 apr ?